Whether in the bustling streets of London's financial district or in the noisy classrooms of high school students, the rise of generative artificial intelligence (AI) has captured the imagination. But is the hype justified? And what might it all mean for investors? One conclusion that can already be drawn is that AI has clearly reached a new, more dynamic phase in its development. Thanks to the emergence of large data sets, cloud architecture and a new breed of powerful semiconductors, the conditions are in place for the technology to extend its reach into new realms.

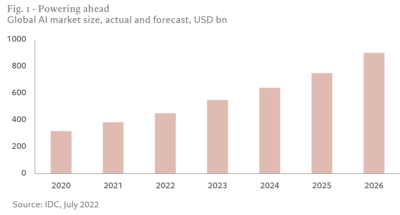

According to the International Data Corporation, the global AI market, including hardware, software and services, is expected to grow by nearly 19 per cent a year, reaching USD900bn by 2026 (see Fig. 1).

But those figures only tell part of the story. Its economic impact could be huge- Goldman Sachs estimates that AI could add some USD7 trillion to the global economy over the next decade, thanks in part to the improved productivity it brings.1

What makes generative AI so much more powerful than its predecessor is that it uses machine learning (ML) to create brand new content that is virtually indistinguishable from what humans can generate. It can, for example, create characters and storylines in online games, put together financial reports and process increasingly complex customer service questions.

ChatGPT, developed by privately-owned OpenAI, with Microsoft as the main shareholder, is the most high-profile example of the technology. For the uninitiated, GPT stands for Generative Pre-trained Transformer - a form of large language model (LLM) trained on massive, broad and unstructured data sets. The AI chatbot is able to use a novel deep learning process known as a transformer to provide seemingly human-like answers to users' text prompts. OpenAI has also developed a solution for image generation (DALL-E 2) and another for speech generation (Whisper).

Yet these new technologies haven't come out of thin air. AI systems have seen steep progress over the past two decades. Those advances have come courtesy of significant computational resources as well as the development of powerful micro-processors and advances in memory storage.

Monetising the machines

Investment managers of Pictet Asset Management's Digital, Robotics and Security strategies expect to see the rapid adoption of LLMs for commercial use.

It is too soon to have a clear view on which companies might benefit most from AI, but what we can say with greater confidence is that the initial opportunities will fall to firms operating in three main technology sectors.

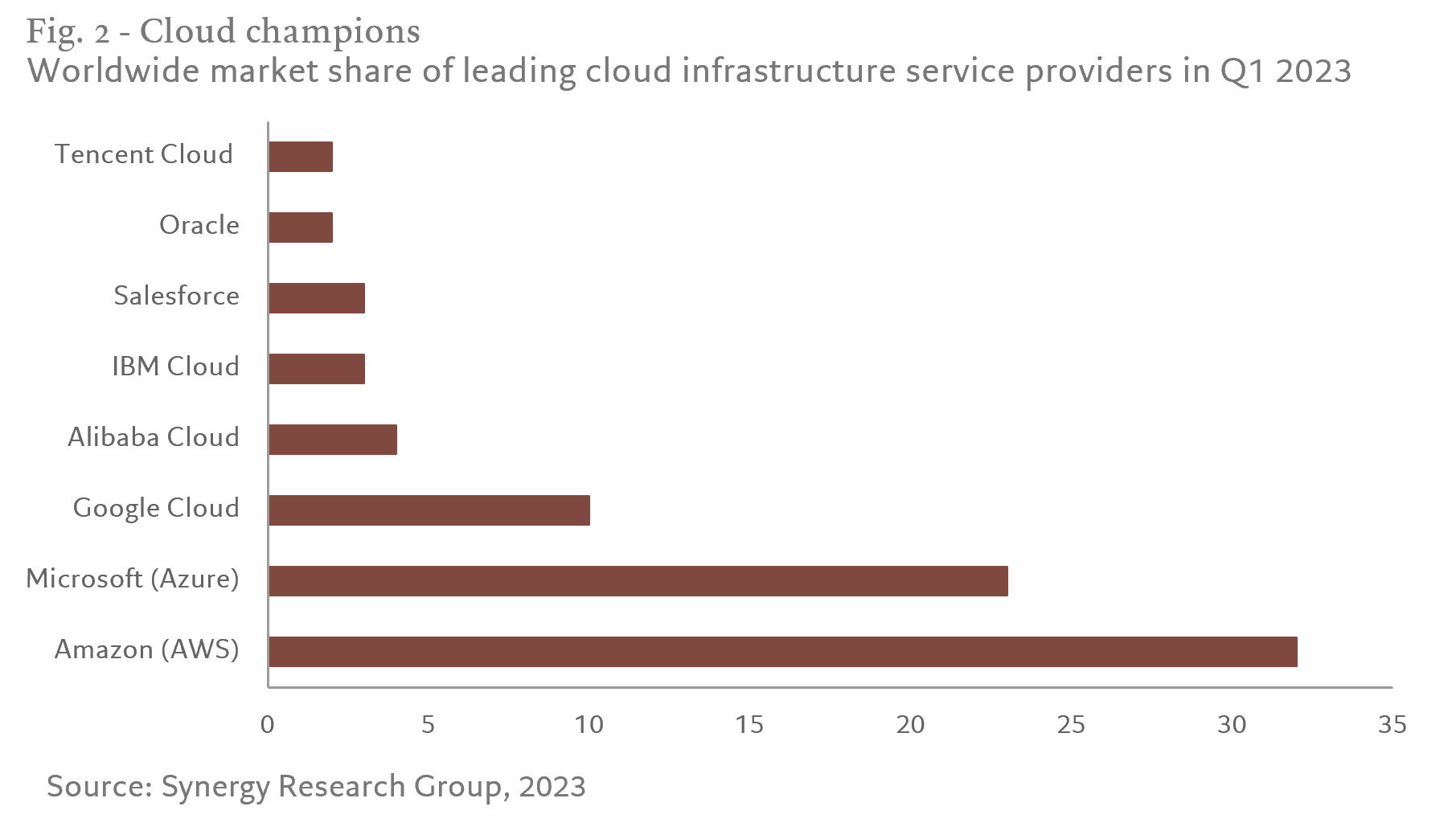

The first is cloud infrastructure.

Data-centric generative AI needs a powerful cloud infrastructure provided by large cloud platforms known as hyperscalers. These include AWS (Amazon Web Services), GCP (Google Cloud Platforms), Microsoft Azure and Meta (private cloud). Together, they represent around 78 per cent of all global cloud capacity (see Fig. 2). Cloud infrastructure service revenue reached USD63.7 billion in the first three months of 2023, a year-on-year increase of USD10 billion, and we expect strong growth to continue.

Semiconductor companies could be big beneficiaries, too.

Computational power for AI/ML comes mainly from the development of graphical processing units (GPUs) which are needed to run generative AI models and can optimise the training of large data sets (i.e. LLMs) because of their high-speed parallel processing capabilities. But even beyond GPUs, we view semiconductor and semiconductor equipment companies in general as big beneficiaries of generative AI with semiconductor demand increasing as more computing, memory and networking solutions will be needed. Moreover, producing these increasingly complex semiconductors demands ever more sophisticated equipment. It is no coincidence that semiconductor manufacturing equipment sales topped USD100 billion in 2022,2 setting a fresh record, and we expect this trend to continue.

Chip company Nvidia has been one of the main beneficiaries of the increased computational requirements to power AI algorithms like ChatGPT, which run on the firm's high-end datacentre accelerator chips such as the A100 and the new H100. Such chips now account for over half of Nvidia's revenues.

The majority of computer functions, however, are still carried out by more pedestrian core processing units (CPUs). Here, Intel remains the market leader, but California-based AMD has gained significant market share in recent years.

Whether it is CPUs or GPUs, there is growing demand for ever more advanced chips.

Yet it is becoming harder to make them smaller, smarter and cheaper. Indeed, it now costs hundreds of millions of dollars to design a new leading edge chip. Ironically, AI can help to produce those new chips, through the use of electronic design automation (EDA) tools developed by companies like Synopsys and Cadence. Synopsys has launched an entire AI suite of EDA tools which have already designed over 200 new microchips.

Software firms could also emerge as winners in the generative AI era. Those that manage to incorporate AI into their products stand to enjoy a major competitive advantage. Microsoft's GitHub Copilot is the best scaled example of AI in software today. In a study released by Microsoft, developers coding with it were more productive, delivering improved output in 55 per cent less time, all for around USD100 a year for their ‘co-pilot' subscription.3

Another software company in the race to incorporate AI is Adobe's through its model Firefly, which is trained on its 175 million copyright-free stock images, making copyright-compliant image generation a possibility across their suite of products.

When it comes to cybersecurity software, the industry may have to adapt to use generative AI to counter potential threats from malicious code written by other machines. AI should allow for faster detection of and response to attacks. CrowdStrike and Palo Alto are two of the companies already embracing the power of AI in their cyber security platforms. In time, cyber security will also play a big role in protecting the data used by AI applications, and ensuring the quality of that data.

As we assess the impact that AI will have for cybersecurity companies and business users, the most likely outcome in our view is gains in efficiency (i.e. a reduction in the time to detect and respond to attacks). Generative AI will have a big part to play in augmenting or outright eliminating many of the routine tasks that cybersecurity agents face in their day-to-day work.

Hurdles ahead

For all the promise of AI, there are perils too. Which means regulation will have a major role to play in the development and diffusion of the technology.

Already, there are major concerns over data accuracy, copyright infringement, privacy and market concentration. Some of these worries are already being addressed. AI can, in certain setting, self-police. Pre-trained AI models are being used in content moderation, for example, to guard against toxicity. With time more such models and use cases will be developed.

Yet there is also alarm over what AI might mean for our livelihoods and whether, left unchecked, it could pose more serious threats to society.

Official regulation of such technology is also crucial - something both governments and companies themselves are actively working on. OpenAI co-founders have called for an equivalent of the International Atomic Energy Agency to be set up to "inspect systems, require audits, test for compliance with safety standards, [and] place restrictions on degrees of deployment and levels of security".

Early days

Yet, as the technology develops, solutions will no doubt be found. While mindful of the risks, we still believe that AI today is at an inflection point that can be compared to the early days of the iPhone over 15 years ago, which paved the way for the use of smartphones and mobile applications and the rise of AWS as the first cloud provider. Now AI technology is revolutionising the next generation of tech start-ups.

The likes of ChatGPT have only touched the surface. We are confident AI will disrupt business models, drive operational efficiencies and create strategic differentiation over the next decade.

The likes of ChatGPT offer only a glimpse of AI's possibilities. We are confident AI will disrupt business models, drive operational efficiencies and create strategic differentiation over the next decade. There will be bumps in the road, but generative AI is clearly here to stay.

[1] Goldman Sachs, Generative AI - Part I: Laying Out the Investment Framework, March 2023

For more on our approach to Robotics Investing. Click here

This article is funded by Pictet Asset Management

This material is for distribution to professional investors only. However it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation.