9 things to know about China’s bond markets - China’s bond markets have historically been underutilised by many foreign investors, but things are changing.

China's bond markets have historically been underutilised by many foreign investors, but things are changing. Steady reforms, an increasingly internationalised currency and attractive yields are resulting in increased inflows. Read these nine tips to understand the essentials of investing in China's fixed-income marketplace.

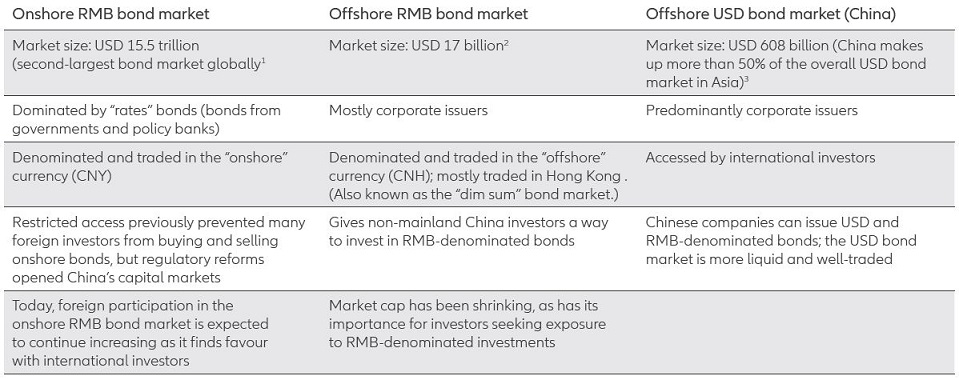

1. There are three main ways to access China's bond markets.

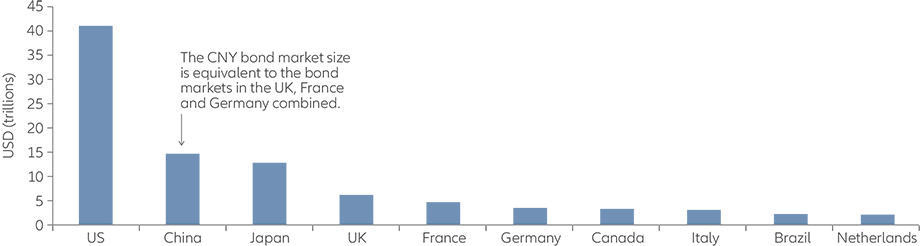

China's fixed-income marketplace isn't monolithic, but it is massive. The onshore RMB segment alone is bigger than those in France, Germany and the UK combined (see Exhibit 1).

Exhibit 1. Three different investable markets for Chinese bonds

2. China's currency has several names, but "renminbi" is arguably more important for bond investors.

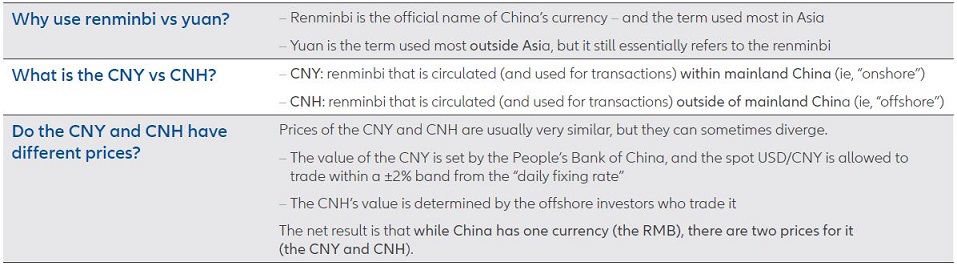

Outside of Asia, "yuan" is generally the term used to describe China's currency. But "renminbi" (abbreviation: RMB) is the official legal name of China's currency, and the term used the most in China and in Asia overall. Bond investors should be aware of the two kinds of renminbi (see Exhibit 2) used in financial transactions. -

- In "onshore" China (sometimes called mainland China), transactions are done using the onshore traded renminbi (abbreviation: CNY). This is where "onshore RMB"/"onshore CNY" bonds get their name.

- In "offshore" regions (those outside of mainland China), transactions are done using the offshore traded renminbi (abbreviation: CNH). This is where "offshore RMB"/"offshore CNH" bonds get their name.

China's regulators are intent upon making the onshore RMB currency (the CNY) a more "internationalised" one - similar to how the US dollar (USD) is used around the world to conduct transactions. That makes the onshore RMB bond market increasingly important.

Exhibit 2. Key renminbi facts for fixed-income investors

3. China's onshore RMB bond market is large and growing

The total value of China's onshore RMB bond market reached USD 15.5 trillion at the end of 2020, and many market participants are expecting the market to grow significantly in the coming years (see Exhibit 3).

China's onshore RMB bond market is also diverse, with three main segments of the market: money market instruments, "rates" and "credits".

- Rates bonds form the largest segment of the onshore RMB market (55% as at 30 June 2020). This group broadly consists of central government bonds (CGBs), local government bonds (LGBs) and bonds from policy financial banks (PFBs, which are large financial institutions owned by the Chinese government).

- Credit bonds encompass issues from government-linked financing entities, state-owned enterprises (SOEs), financial institutions (such as banks and insurers) and privately owned (non-government) corporations. Credits make up about a quarter of the onshore RMB market.

- Money market instruments issued by banks and corporations make up the rest of the onshore RMB bond market.

Exhibit 3. Outstanding bonds by market

Source: Chinabond, Chinaclear, Wind, Standard Chartered Research. Data as at 30 June 2020.

This post was funded by Allianz Global Investors

Investing involves risk. The value of an investment and the income from it may fall as well as rise and investors might not get back the full amount invested. Past performance is not a reliable indicator of future results. The Management Company may decide to terminate the arrangements made for the marketing of its collective investment undertakings in accordance with applicable de-notification regulation. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Further information on Investor Rights are available here (www.regulatory.allianzgi.com), Allianz Global Investors GmbH has established a branch in the United Kingdom, Allianz Global Investors GmbH, UK branch, 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk, deemed authorised and regulated by the Financial Conduct Authority. Details of the Temporary Permissions Regime, which allows EEA-based firms to operate in the UK for a limited period while seeking full authorisation, are available on the Financial Conduct Authority's website (www.fca.org.uk). Details about the extent of our regulation by the Financial Conduct Authority are available from us on request.