The Federated Hermes Credit team has spent many years refining what we consider to be a best-in-class ESG-integrated investment process, which is standard across our suite of products. We believe there is a direct link between ESG risk and credit risk.

In the year of the introduction of Sustainable Finance Disclosure Regulation (SFDR) and COP26, it is an opportune time to consider what a best-in-class ESG and Sustainable Credit proposition looks like. We offer an example of what can be achieved when investment teams collaborate with a centralised Responsibility Office, like the one we have at the international business of Federated Hermes.

Financial markets have seldom been more interested in ESG, sustainability and stewardship than they are today. While this is fundamentally a positive trend that we believe will come to define financial markets in the future, it also makes it difficult for prospects and existing clients to distinguish asset managers who integrate ESG, sustainability and stewardship in a genuine fashion from those who consider it to be a box-ticking exercise that makes for good marketing.

Our philosophy

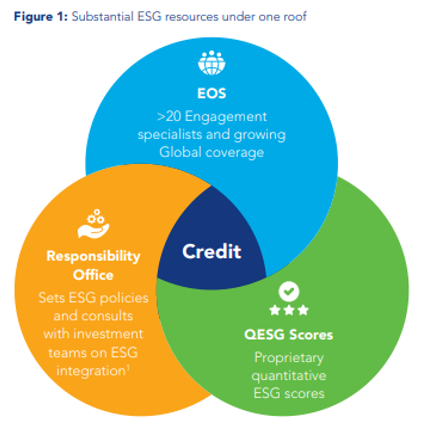

The Federated Hermes Credit team has spent many years refining what we consider to be a best-in-class ESG-integrated investment process, which is standard across our suite of products. We believe there is a direct link between environmental, social and governance (ESG) risk and credit risk, and see no separation between ESG-integrated investing and more traditional investing based purely on financial metrics. Our approach not only relies on inputs from various external data providers (such as, amongst others, Sustainalytics, Trucost and MSCI), but also builds on the extensive experience of our EOS engagement platform and the bottom-up work of individual analysts. Our methodology aims to capture the positive movement in a company's ESG characteristics and not rest on annual data inputs. The insight we gain from engaging with companies is an important ongoing additional input into our fund managers' investment considerations as we place a strong focus on driving positive change within investee companies. We believe that there is an opportunity to add alpha by investing in companies that may score poorly in ESG behaviours as measured by the traditional data providers, but show an earnest desire to improve those ESG behaviours. This can be achieved by investing and engaging with the company prior to its ESG risk reduction being priced into market consensus.

In addition to active ESG, which is standard across our range of products, there are mandates that go a step further and incorporate an objective on sustainability alongside a traditional financial objective.

We have identified three pillars for achieving client investment goals, which can be accommodated, tailored, and managed within our dynamic and scalable process.

The three pillars are:

1. Active ESG: Assess ESG risks within the investment process, including engaging with companies to improve against these metrics.

2. Sustainable: Fund the most sustainable companies, whilst excluding harmful businesses and engaging all to improve.

3. Impact: Generate positive impact to society and the environment by investing and engaging with companies in transition.

While objectives on sustainability are independent of the financial objective of the fund, we believe there is a collinear and self-enforcing nature to both goals which can benefit investors and society over the long term.

Process: from idea to advocacy

Our holistic approach to ESG integration considers ESG factors within all stages of the investment process, from initial universe screening through to stewardship and advocacy. Our process begins when screening global credit markets to create our core investible universe (the universe from which portfolio managers can select securities). We are able to ‘screen in' securities on which we have high conviction from a sustainability perspective (as indicated by our proprietary sustainability scores) but which are not already captured by other criteria. This means we are able to include securities that would not necessarily screen highly if considered from the purely financial angle of our investment process.

In addition to this, the team operates a minimum ESG threshold for investment. Using our proprietary and forward looking ESG scoring system, the lowest scoring issuers from an ESG perspective are excluded from portfolios. Finally, Federated Hermes has a firm-wide exclusions policy that is incorporated into the credit funds.

For investment solutions governed by a sustainable investment objective alongside a financial investment objective, the engagers takes the lead in the development and maintenance of sustainable investment processes and proprietary sustainability scores. For the purposes of these solutions, the sustainability scores act as a further lens to review and screen the investible universe to ensure the portfolio is constructed in a way that feeds into the sustainable objective of the strategy.

At Federated Hermes, we aim to go a step further in the integration of ESG factors into our investment processes. We avoid traditional, backward-looking box-ticking and, instead, consider ESG within our holistic investment process.

This post was funded by Federated Hermes

Disclaimer: The value of investments and income from them may go down as well as up, and you may not get back the original amount invested.

For professional investors only. The views and opinions contained herein are those of the author and may not necessarily represent views expressed or reflected in other communications. This does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments. Issued and approved by Hermes Investment Management Limited which is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET.