Key points

- The volatile start to the year in financial markets is set to continue for a while yet.

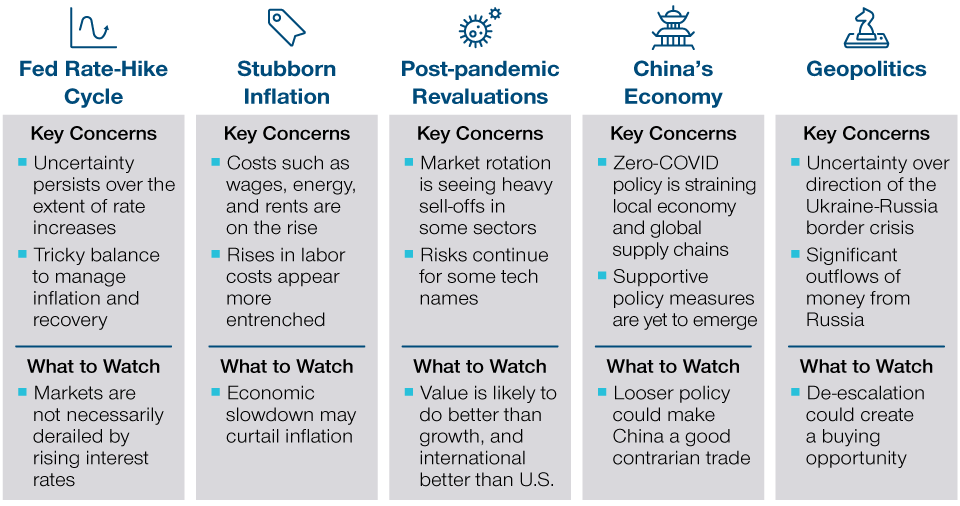

- Fed hikes, surging inflation, a post‑pandemic repricing in stock markets, the Chinese economy, and the Ukraine‑Russia border dispute have the potential to disrupt markets.

- Steering a course through this environment will be very challenging, but market volatility and sector rotation should present good opportunities for active investors.

The volatile start to the year in financial markets is unlikely to abate soon. Sustained inflation, a looming Federal Reserve (Fed) rate‑hiking cycle, tightening liquidity conditions, and the unwinding of pandemic‑era economic distortions—among other factors—mean that further price fluctuations can be expected.

The Forces Driving Markets This Year

Five key developments to monitor

Although it is too early to say that we are entering a post‑COVID world, it is clear that the pandemic is no longer the dominant driver of markets that it has been. The new environment will be difficult to navigate—but it will also provide some excellent opportunities for stock pickers.

Fed Hikes Alone Tend Not to Derail Markets

Anxiety over Fed rate hikes was the primary cause of recent volatility. For most of last year, the Fed maintained a dovish stance, focusing more on reducing unemployment than curbing inflation. Then, in its December monetary policy meeting, it made it clear that rates would soon be rising. This prompted the markets to immediately price in rapid policy tightening, hence the declines in financial markets during January.

Markets initially responded positively to the Fed's January statement, which confirmed March as the target for a rate hike. However, comments from Fed Chair Jerome Powell at the subsequent press conference changed the mood dramatically. "I think there's quite a bit of room to raise interest rates without threatening the labor market," said Powell—implying that the Fed may adopt a more aggressive hiking cycle than expected. Markets, which had been pricing in four hikes in 2022, suddenly had to price in more—sparking another bout of volatility.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.