Q: How is technology helping to create a more sustainable world, which areas in particular within the tech landscape are the best facilitators?

We very much see technology as the science of solving problems, and as a result, a key enabler towards a more sustainable world. We think there's a natural synergy for technology to provide solutions to these major environmental and social challenges, and as a consequence, this allows access to some of the largest growth markets out there. The technology sector is on the right side of that by providing the innovation, those exponential leaps that only technology can provide. No one thought that EVs (electric vehicles) would ever take off in a broad sense, and again, technology's enabled EVs to be a real credible alternative to internal combustion engine cars and we're now finally seeing that inflection.

We look at the investment landscape and we very much feel that there's much more breadth to those opportunities, to those growth areas in technology than is currently being addressed in most sustainable investing today. Because it's not just renewables, it's not just electric vehicles. We think about a wider sustainable transport revolution. So we think about ride hailing, about autonomous driving because it's not just about the pollution and the carbon emissions, it's also about reducing the number of accidents and fatalities on the road.

Improved efficiency and productivity are also being made possible by technology. We need to reduce the use of scarce natural resources and we need low carbon infrastructure, we need smart cities to do that as well. So we think there are many technologies that provide solutions to those environmental challenges, and more uniquely to social problems too.

Q: There are many examples to support the role of technology in providing remedies to environmental issues, but there may be a lack of recognition when it comes to social challenges. Can you elaborate on that.

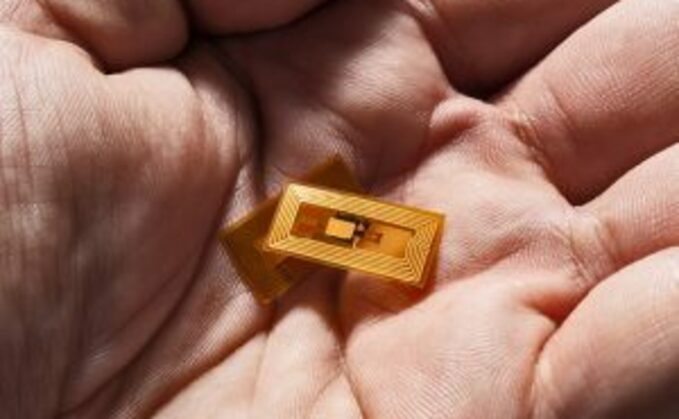

The social side is a somewhat neglected area of the power of ‘technology doing good'. Access to quality healthcare, financial inclusion, digital democratisation (making tech accessible to more people), tech health and data security are exciting themes. There's often a huge focus on the mega-caps when we talk about technology, and there seems to be a lack of realisation of the good that many technology companies do around the world, across both developed and emerging markets. Thinking of financial inclusion, that used to be very much reliant on the expansion of a physical bank branch into a second-tier town, then a third-tier town and then in some of the rural areas, which may well take 50 or 100 years. Now, it can be done with the swipe of a card or a download of an app. People that have never had any credit history, could never access credit to start a business or to get that initial loan or some risk capital to actually be able to start up a business or invest, we've seen this progress in China, India, and Latin America.

The critical mass and adoption acceleration that some tech platforms now have around the world, often in places that don't have very established healthcare or education systems, has meant that more people are able to access quality education and healthcare by leveraging the internet, the cloud and AI (artificial intelligence). The pandemic has forever changed the way we work and learn, making online learning, home schooling and telemedicine possible. We've seen a huge acceleration of these trends from the pandemic and near term the digital divide has only exacerbated the rising inequality we have witnessed globally. We believe longer term, the critical mass lockdowns provided to these more nascent technology platforms and the widespread government support to level up economies, will ultimately help reduce poverty and inequality.

Q: While tech is doing a lot of good, we also have the less desirable effects around individual privacy, data security and management. What's your view around this and what role can investor engagement play?

The United Nations has updated the interpretation of human rights to embrace the digital world. What's very positive for us is the maturing of the technology sector in terms of responsibility, as we've seen in their interaction with regulators and governments. What's happened in the last ten years, particularly the scrutiny in the last five years, has meant that tech companies aren't just disrupting an industry and then worrying about the aftermath and the implications of scaling to billions of users. Maybe the infrastructure or data security and privacy policies weren't 100% right or they hadn't thought more thoroughly about every potential outcome or indirect consequence of the new technology, product or service. I think now there's much more of a realisation and impetus to think about these implications in advance because if not, the company is likely to be hauled in front of US Congress or the European Commission fairly quickly.

We've witnessed a lot more proactive engagement from companies with governments, with regulators, with local authorities and cities, proof that tech companies are now very much working in partnership with these institutions to come up with solutions. An example of this is the allowing of autonomous vehicles and self-driving vehicles on US roads, albeit some states are much more proactive than others . These partnerships will hopefully lead to a more stringent framework of rules and regulations that also ‘protects tech companies from themselves', by being on the right side of the authorities. We think a lot of the regulation we've seen in the Chinese internet sector is actually very positive and leverages much of the learnings that we've seen globally, particularly in the European Union with GDPR (General Data Protection Regulation).

Find out more on the important factors investors should consider when investing in the tech sector, how tech innovation is inherently a deflationary force, and how technology is a truly broad sector, offering an opportunity set beyond the standard classifications of a tech company.

This post was funded by Janus Henderson Investors

The views presented are as of the date published. They are for information purposes only and should not be used or construed as investment, legal or tax advice or as an offer to sell, a solicitation of an offer to buy, or a recommendation to buy, sell or hold any security, investment strategy or market sector. Nothing in this material shall be deemed to be a direct or indirect provision of investment management services specific to any client requirements. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, are subject to change and may not reflect the views of others in the organization. It is not intended to indicate or imply that any illustration/example mentioned is now or was ever held in any portfolio. No forecasts can be guaranteed and there is no guarantee that the information supplied is complete or timely, nor are there any warranties with regard to the results obtained from its use. Janus Henderson Investors is the source of data unless otherwise indicated, and has reasonable belief to rely on information and data sourced from third parties. Past performance does not predict future returns. Investing involves risk, including the possible loss of principal and fluctuation of value.

Not all products or services are available in all jurisdictions. This material or information contained in it may be restricted by law, may not be reproduced or referred to without express written permission or used in any jurisdiction or circumstance in which its use would be unlawful. Janus Henderson is not responsible for any unlawful distribution of this material to any third parties, in whole or in part. The contents of this material have not been approved or endorsed by any regulatory agency.

Janus Henderson Investors is the name under which investment products and services are provided by the entities identified in the following jurisdictions: (a) Europe by Janus Capital International Limited (reg no. 3594615), Henderson Global Investors Limited (reg. no. 906355), Henderson Investment Funds Limited (reg. no. 2678531), Henderson Equity Partners Limited (reg. no.2606646), (each registered in England and Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the Financial Conduct Authority) and Henderson Management S.A. (reg no. B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by the Commission de Surveillance du Secteur Financier).

Janus Henderson, Janus, Henderson, Intech, Knowledge Shared and Knowledge Labs are trademarks of Janus Henderson Group plc or one of its subsidiaries. © Janus Henderson Group plc.