The economist Paul Samuelson once famously said: "When the facts change, I change my mind. What do you do?"

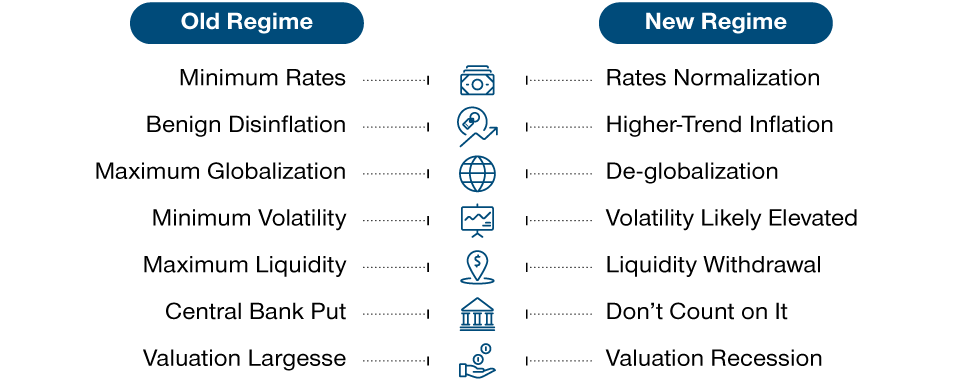

Many economic facts have changed over the past few quarters. In fact, everything I'm witnessing tells me that we are undergoing a paradigm shift in investing. We are moving from a world of benign disinflation to one of higher-trend inflation. From a very low interest rate environment to a rising rate environment. From a long period of low volatility to a period in which volatility will likely be elevated. From globalization to de-globalization, or friend‑shoring, as former Federal Reserve (Fed) chair Janet Yellen calls it. From maximum liquidity to liquidity withdrawal. And perhaps most importantly, from an era of elevated valuations in both equities and rates to one closer to the historical norm (Figure 1).

How can investors respond to this?

Learning the Lessons of History

To understand the present, it sometimes helps to study the past. In the mid‑1960s, for example, inflation began to rise following a long period of generally low inflation. It continued to rise throughout the 1970s and into the early 1980s—a period that became known as the Great Inflation—and incorporated four recessions, two severe energy crises, a lengthy period of stagflation, and previously unseen levels of peacetime wage and price controls.

To understand the present, it sometimes helps to study the past.

The Great Inflation lasted until 1982, but the seeds of its reversal were sown four years earlier when Arthur Burns' tenure as Fed chair came to an end. During his eight‑year period in charge, Burns showed little inclination to tackle inflation and was widely regarded as being a political pawn. At President Nixon's behest, Burns cut interest rates just when they should have been raised, fuelling a U.S. economic boom ahead of the 1972 election.

Out With the Old, In With the New

(Fig. 1) The paradigm shift taking place in investing

As of August 31, 2022. Source: T. Rowe Price.

Burns was replaced in 1978 by George William Miller, but it was Paul Volcker, who took over as Fed chair in 1979, who really brought about the end of the Great Inflation. Volcker, who understood that the central bank had a vital role to play in tackling inflation, immediately hiked interest rates. This led to the painful 1980-1982 recession and elicited widespread protests as well as political attacks, but it also introduced a new era of disinflation.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2022 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.