We view current valuations as an attractive entry point into global fixed income markets, against a tough but broadly priced-in market backdrop. We do not dismiss the risks, although the flexibility offered by the strategic bond mandate enables us to capture opportunities and navigate potential hurdles as we seek to deliver value for investors.

Steep inflation and subsequent monetary policy tightening - combined with a weakening economy and unnerving geopolitics - have created a ‘perfect storm' for bond markets. We have seen vigilante-style routs leading to higher bond yields, while spreads are now closing in on the high levels seen during the COVID-19 crisis. These broad market moves have led us to historically attractive valuations across the asset class.

Peak economic growth and sticky inflation - but have we reached a turning point?

Inflation has dominated and continues to steer market sentiment. We have, however, seen strong counter-trend rallies in the US on the perception of a Fed pivot towards a more dovish stance and hopes that inflation has peaked. Fed officials have been quick to discount this, telling the market ‘not so fast'. Now, though, early signs of a turn in inflation are being hinted at through various indicators. Even once we reach a peak, it is still unclear how quickly prices will return to ‘normal'.

Chart 1: Consumer Price Inflation year-on-year

Source: Aegon AM. As at 31/8/22.

Much-needed interest rate hikes are underway - is the full extent now priced in?

Interest rate hikes have been an inevitable consequence of tackling the inflation problem. Most of these hikes now seem to be priced-in, with rates set to exceed 3% across many economies. This includes the European Central Bank and Swiss National Bank, both waving goodbye to negative deposit rates. Expectations for future interest rates are now better aligned with the outlook for inflation, although looming recession or a fall from peak inflation could question this position.

Chart 2: Central bank interest expectations

Source: Aegon AM. As at 6/10/22.

What does this mean for our portfolio positioning?

Government bonds

We believe yields could still be pressured higher by rising inflation and subsequent central bank tightening, although the bulk of the heavy lifting is behind us. We favour incrementally adding duration, while looking for signs of a peak in inflation rates and yields to begin adding more meaningful interest rate risk. Curve positioning and relative-value cross-market positions have been important to generating alpha; we have implemented a curve-steepening position in the US and continue to identify disparities across rates markets to add relative-value positions.

Chart 3: 10-year yields on core government bonds

Source: Aegon AM. As at 30/9/22.

Investment grade credit

Credit fundamentals generally remain robust. We expect cost/margin pressures to increase, although this is an equity story rather than a credit story. Spread levels are at multi-decade wides and now more than compensate you for the macroeconomic outlook. Market volatility will remain the key risk to this. We have a strong overweight in investment-grade credit, with a preference for financials and less cyclical corporates, as well as companies rated at the higher end of the credit-quality spectrum.

Chart 4: Investment grade cross-market spreads

Source: Aegon AM. 10 years to 30/9/22.

High yield credit

Central bank actions have led to improved and attractive valuations, both in spreads and all-in yield available across credit markets. Corporate fundamentals are also strong in high yield companies, although careful security and sector selection remains paramount to generating alpha.

We favour the European high yield market versus the US and seek shorter-dated, higher-spread assets. In 2023 we believe we will see an increase of default rates in the high yield market from the current historic lows of 2%, to around 5%. The market is currently pricing in a double-digit default rate in European high yield for next year, which we don't believe will materialise. This leaves present valuations in high yield looking very attractive.

Chart 5: US High Yield Index - Yield-to-Worst

Source: Aegon AM. 10 years to 30/9/22.

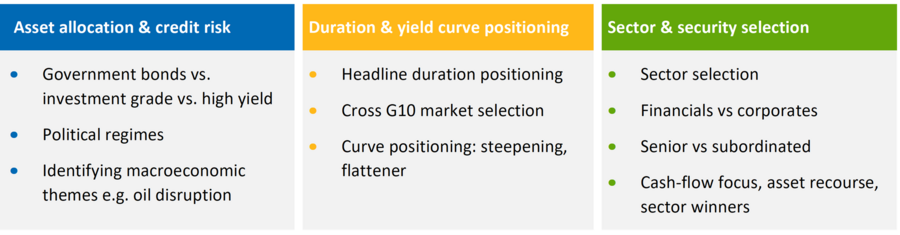

The market opportunity for strategic bonds

Our strategic bond strategies offer a flexible and dynamic approach to navigating uncertain markets, drawing upon a variety of tools to capture opportunities. The strategy is high-conviction and index-unconstrained. We target six sources of alpha-generation alongside the management of market beta as we seek to deliver superior risk-adjusted returns for investors.

Our opportunity set and the range of tools at our disposal allow us to both protect the portfolio on the downside and capture capital upside with agility and efficiency. This approach has proved historically successful across many market conditions, including the COVID-19 pandemic, Euro-sovereign crisis, Fed taper tantrum and the 2008 Global Financial Crisis. While the outlook for global bond markets continues to look uncertain, we believe our alpha-driven approach will benefit investors as we identify areas of value in fixed income markets and position ourselves for a turning point.

Disclaimer:

For Professional Clients only and not to be distributed to or relied upon by retail clients.

The principal risk of this service is the loss of capital. Please note that other risks will be present.

Opinions and/or example trades/securities represent our understanding of markets both current and historical and are used to promote Aegon Asset Management's investment management capabilities: they are not investment recommendations, research or advice. Sources used are deemed reliable by Aegon Asset Management at the time of writing. Please note that this marketing is not prepared in accordance with legal requirements designed to promote the independence of investment research, and is not subject to any prohibition on dealing by Aegon Asset Management or its employees ahead of its publication.

All data is sourced to Aegon Asset Management UK plc unless otherwise stated. The document is accurate at the time of writing but is subject to change without notice.

Aegon Asset Management UK plc is authorised and regulated by the Financial Conduct Authority.

AdTrax: 5065187.1 Exp Date: 31 October 2023.