The themes we highlighted in the Vanguard Economic and Market Outlook for 2023: Beating Back Inflation—persistent inflation, tight labour markets and rising policy interest rates—remain at mid-year. Developed market economies have proved resilient. Labour markets have remained strong, leading to slower-than-expected disinflation. Wage pressures have moderated but remain persistent, especially in service industries. As a result, central banks have needed to raise monetary policy rates somewhat higher than we had anticipated.

We expect continued progress in the fight against inflation, with central banks having to keep interest rates in restrictive territory for longer. And with that, we anticipate some economic weakness to come in the months ahead.

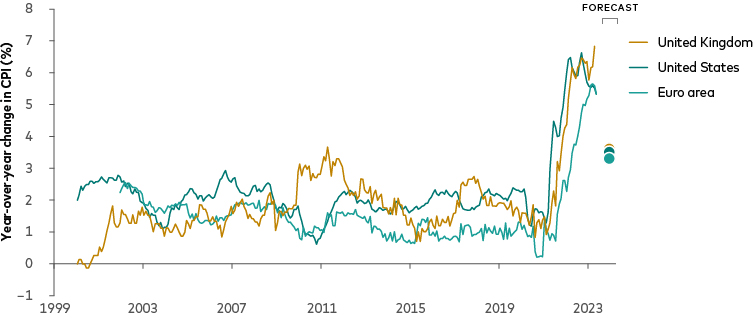

The last mile to tame inflation may take some time

There's been progress in the fight against inflation. But it's too early to declare victory. Vanguard foresees developed market core inflation (which excludes food and energy prices) continuing to fall through to the end of 2023 from recent generational highs. But we expect it will only be late 2024 or even 2025 before inflation falls back to central banks' target levels, which are mostly around 2%.

We believe central banks have more work to do. We've always believed inflation wouldn't come down magically, even as post-pandemic supply chain issues were resolved. The pandemic accelerated demographics-driven changes to labour markets. Strong demand for workers who can command higher pay than historical standards requires monetary policy that is clearly restrictive. The last leg of inflation reduction to central bank targets may be the most challenging, in our view.

That last leg is also likely to vary by region. The initial catalysts for the surge in inflation were global in nature, and the pace at which inflation travels that last mile to the target level will depend more heavily on local drivers: how restrictive policy tightening is in each country or region, as well as local demand, labour market and housing dynamics.

Inflation and monetary policy elevate the risk of recession

In the United States, policymakers have paused in what had been a relentless cycle of rate hikes - but the US Federal Reserve (Fed) has hinted they will resume lifting rates.

The recovery from the shortest recession in more than 150 years—a two-month downturn in early 2020—has endured one of the most aggressive interest rate-hiking cycles in the Fed's history. Recent growth has been stable at about 2%, annualised. We still assign a high probability to a recession, though the odds have risen that it could be delayed from 2023 to 2024. Housing inflation should slow in the second half of 2023 and return to its pre-pandemic pace by 2024. Slowing momentum in labour markets should also lower ex-housing services inflation later this year.

In our initial outlook for 2023, we described a weakening of the labour market (along with slowing growth) as a necessary condition for falling rates of inflation. The labour market has had its own idea, remaining resilient even as disinflation has continued. Unemployment remains below 4%, where it stood when the Fed started its current rate-hiking cycle. We continue to expect some softening.

Given the long and variable lags between monetary policy shifts and discernible changes in economic activity, Fed policymakers could decide that the 500 basis points (5 percentage points) of interest rate hikes they've enacted since March 2022 are enough to knock inflation down to their 2% target. But we view at least one more rate increase as probable.

Euro area and the UK

In the euro area, we expect the slight economic contraction in the fourth quarter of 2022 and the first quarter of 2023, likely caused by the energy crisis, to give way to a new but short-lived expansion. Another downturn is likely to arrive this year or next, as the lagged effects of monetary policy tightening are realised.

By any measure, euro area inflation has declined meaningfully. Falling energy prices should help the headline inflation rate to ease further in the coming months. Service-price inflation, linked to wage growth, is stickier and central to our expectation that core inflation will end 2023 at 3.3%, still well above the European Central Bank's (ECB's) 2% target.

The ECB has hiked interest rates by 400 basis points (4 percentage points) in 12 months, and we expect one or two additional increases in 2023. Currently at 3.5%, a deposit rate of 3.75%-4% would represent a restrictive policy stance (the deposit rate is the annualised rate of interest paid by the ECB on banks' overnight deposits). It would exceed our inflation forecast and be more than twice our 1.5%-2% estimate of the region's neutral rate of interest, a theoretical rate that neither stimulates nor inhibits growth.

After peaking in 2020 at 8.6% amid the Covid-19 pandemic, the unemployment rate eased to 6.5% in April 2023. We foresee a partial retracement to 7%-7.5% by year-end, as the ECB's inflation-fighting campaign passes the one-year mark.

As in other markets, we've been surprised by the resilience of the United Kingdom economy. Our initial forecast of a 2023 contraction in the production of goods and services has given way to an estimate of no year-over-year change in output. As elsewhere, we believe a recession remains more likely than a soft landing.

By a variety of measures, notably rates of employment and wage growth, the UK labour market displayed strength in the opening months of 2023. Yet consumers have not been confident about future employment. We expect a modest rise in unemployment in the second half of the year, to 4%-4.5% at year-end.

Strengthening services inflation has driven core inflation in the UK to more than 30-year highs, whereas core inflation is retreating in many other developed markets. We expect core services inflation to drive broader headline inflation in the year ahead as price increases for food, energy and other goods wane. We expect both core and headline inflation in the UK to average 5.3% in 2023, more than a percentage point higher than our view at the start of the year.

We've recently raised our forecast for the Bank of England's terminal rate by three-quarters of a percentage point, to a year-end level of 5.5%-5.75%, given stronger-than-expected inflation data, the continued tight labour market and accelerating wage growth. We maintain our view that rates will not be cut until mid-2024 at the earliest.

China and emerging markets

In China, we now expect year-over-year economic growth of 5.5%-6% in 2023, more than we anticipated at the start of the year. But the bulk of those gains have already occurred, meaning that growth is likely to slow in the second half of the year. Full-year growth above a conservative government target is likely, but three years of policy uncertainty will weigh on confidence.

The labour market has improved steadily since China's post-pandemic reopening, with the headline unemployment rate declining to 5.2%. However, youth unemployment has climbed to a record high, posing a downside risk to growth. We forecast a year-end headline rate of unemployment of 4.7%.

Lower energy and pork prices have contributed to weak inflation readings. A rebound later this year is likely as credit demand strengthens and food and energy prices stabilise. Still, we have nearly halved our initial inflation forecast, to 1% on a year-over-year basis at year-end.

A recent cut to 2.65% for the key 1-year medium-term lending facility by the People's Bank of China should have little tangible economic effect. We believe an additional 10-20 basis points (0.1-0.2 percentage point) of cuts are likely. But China's challenge is a lack of demand for money, not a lack of supply. The likelihood of aggressive fiscal stimulus is low because of an increasing local government debt burden.

Our perception of economic conditions in emerging markets varies by region. In Latin America, inflation appears to have peaked, but we expect central banks to lower their interest rate targets slowly. Meanwhile, the challenges facing the euro area and the UK are magnified in developing Europe. We expect growth of around 1% in 2023 and just below that level in 2024 in the greater Central Europe and Africa regions and core inflation to remain in double digits. We expect emerging Asia to boast sharply higher growth than the rest of the world's emerging markets, with growth of 5.25% this year, cooling somewhat to 5% in 2024.

Slow but sure progress on inflation

Notes: We use year-over-year changes to the core consumer price index (CPI) for all locations. Year-end 2023 figures are Vanguard forecasts.

Sources: Vanguard calculations, using data from the US Bureau of Labor Statistics, Eurostat, and the UK Office for National Statistics accessed through Macrobond on 15 June 2023.

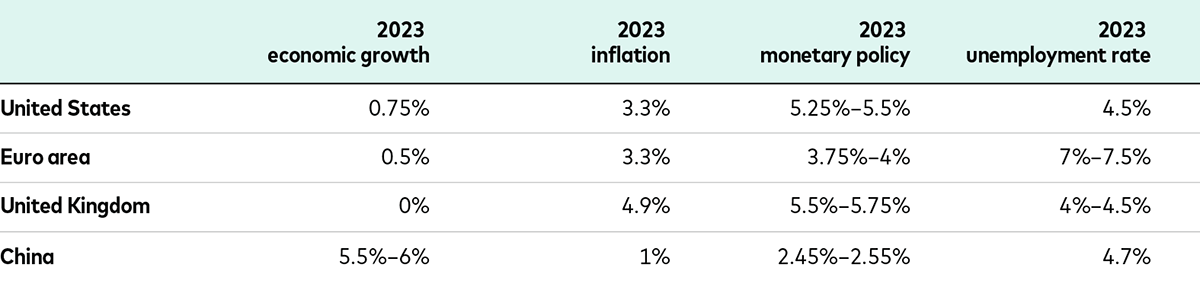

Vanguard's forecasts for year-end 2023

Please note that inflation forecasts are for core inflation, which excludes volatile energy and food prices. Our forecast for the United States year-end monetary policy rate reflects the low end of the Federal Reserve's federal funds target range. Notes: Figures related to economic growth, inflation, monetary policy and unemployment rate are Vanguard forecasts for the end of 2023. Growth and inflation are comparisons with the end of the preceding year; monetary policy and unemployment rate are absolute levels.

Source: Vanguard, as at 26 June 2023.

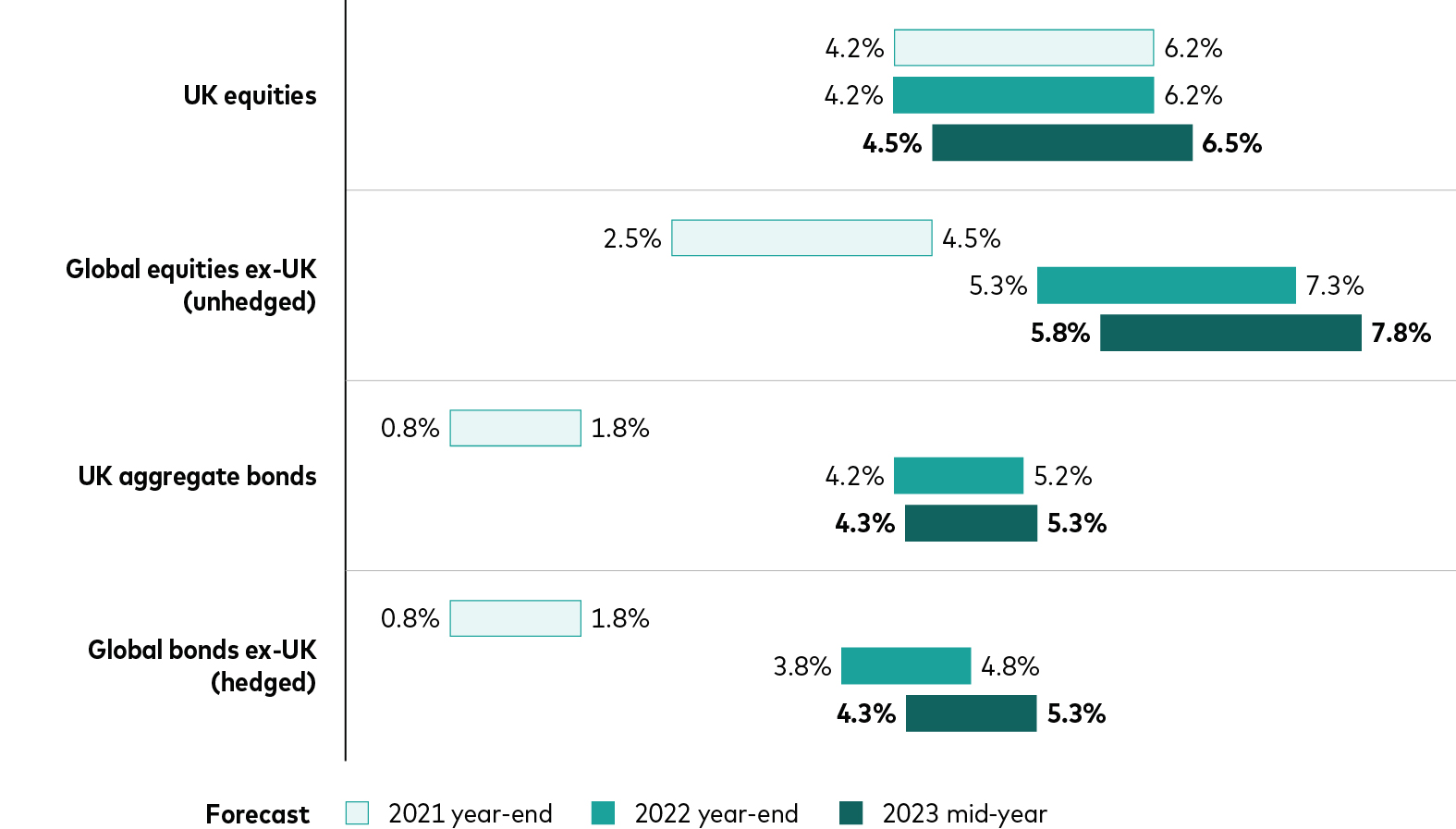

Expected 10-year asset class returns

Equity markets around the world generally have rallied strongly—with the notable exception of China, the dominant emerging market by total value—since we issued Vanguard Economic and Market Outlook for 2023: Beating Back Inflation. For most investors around the world, the gains have reduced the expected returns of global equities excluding local markets.

Bond markets worldwide also generally have recorded solid gains—if only in nominal, not inflation-adjusted terms—since late 2022. Relative to our initial forecast, expected returns have generally declined slightly.

Bucking the global trend of strong equity and solid bond performance, markets in the UK struggled in the first half of 2023. Falling equity valuations and rising bond yields boosted our expectations for 10-year annualised returns in British pounds. Widening interest rate differentials between the UK and the US improved the outlook for global equities and bonds excluding British issues.

Following are our 10-year annualised return forecasts. Forecasts are from the perspective of local investors in local currencies.

Global stock and bond market outlook

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model (VCMM) regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from the VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as at 31 December 2021; 31 December 2022; and 31 May 2023. Results from the model may vary with each use and over time.

Note: Figures are based on a 2-point range around the 50th percentile of the distribution of return outcomes for equities and a 1-point range around the 50th percentile for fixed income. Indices used in VCMM calculations: UK equities: Bloomberg Equity Gilt Study from 1900 to 1964, Thomson Reuters Datastream UK Market Index from 1965 to 1969; MSCI UK thereafter; global ex-UK equities: S&P 90 Index from January 1926 to 3 March 1957; S&P 500 Index from 4 March 1957 to 1969; MSCI World ex-UK Index from 1970 to 1987; MSCI AC World ex-UK thereafter; UK aggregate bonds: Bloomberg Sterling Aggregate Bond Index; Global ex-UK bonds: Standard & Poor's High Grade Corporate Index from 1926 to 1968, Citigroup High Grade Index from 1969 to 1972, Lehman Brothers US Long Credit AA Index from 1973 to 1975, Bloomberg US Aggregate Bond Index from 1976 to 1990, Bloomberg Global Aggregate Index from 1990 to 2001; Bloomberg Global Aggregate ex GBP Index thereafter.

Source: Vanguard.

This post is funded by Vanguard

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Past performance is not a reliable indicator of future results.

Any projections should be regarded as hypothetical in nature and do not reflect or guarantee future results.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard's primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include US and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

Important information

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document does not constitute legal, tax, or investment advice. You must not, therefore, rely on the content of this document when making any investment decisions.

The information contained in this document is for educational purposes only and is not a recommendation or solicitation to buy or sell investments.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.