Reluctantly Bearish

Moving into the second half of 2023, the balance of economic forces still appears tilted against global capital markets. Sticky inflation, central bank tightening, and financial instability all pose clear risks.

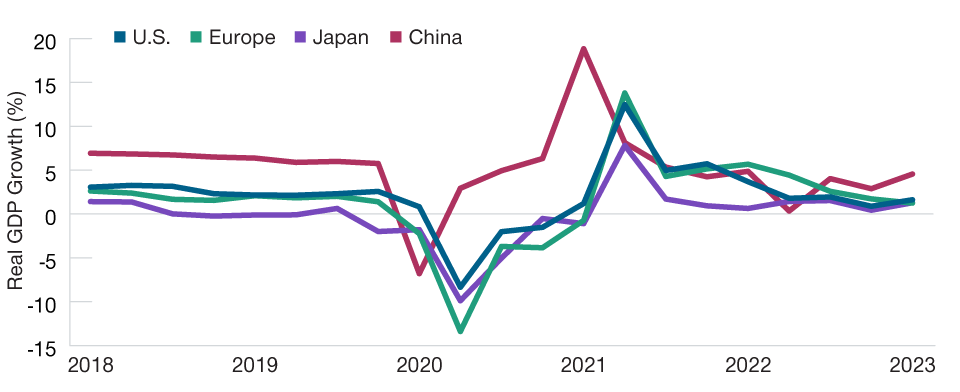

Yet, through late May, economies and markets both showed surprising resilience. Growth remained positive in the major economies (Figure 1), and earnings results came in stronger than expected. Key equity markets posted gains.

Growth Has Slowed but Major Economies Are Not in Recession—Yet

(Fig. 1) Growth in real gross domestic product (GDP), year over year

As of March 31, 2023. Sources: Haver Analytics/US Bureau of Economic Analysis, Statistical Office of the EuropeanCommunities, Cabinet Office of Japan, Japan Ministry of Internal Affairs and Communications,International Monetary Fund.

These results appeared to validate the wisdom of a "reluctantly bearish" approach. Bearish, because the risks are substantial. Reluctant, because excessive pessimism can lead investors to overlook opportunities and miss market recoveries.

It's an open question whether economies and markets can continue to defy the pessimists in the second half, says Sébastien Page, head of Global Multi‑Asset and chief investment officer (CIO).

Many economic indicators, Page notes, are flashing red. But lingering distortions from the COVID pandemic make it hard to distinguish the signal from the noise—the useful information from the meaningless data points.

The strongest bear argument, Page says, is that the economic impact of 500 basis points (bps) of interest rate hikes by the US Federal Reserve has yet to be fully felt. "Every time the Fed has slammed on the brakes in the past, someone's head has gone through the windshield," he warns. "And we've already found out that some banks weren't wearing their seat belts this time."

Although the banking crisis appears contained, its impact on credit conditions will be felt with a lag, notes Arif Husain, head of International Fixed Income and CIO. Resolution of the political dispute over the U.S. debt ceiling also could squeeze market liquidity in the second half, he says, as the US Treasury rebuilds its depleted cash account at the Fed.

Yet, opportunities can be found in select sectors, including small‑cap stocks and high yield bonds. Cheaper valuations and a weaker U.S. dollar also could make global ex‑US equity markets attractive, says Justin Thomson, head of International Equity and CIO. Positive yield curves could do the same for global ex‑US bond markets, Husain adds.

In an uncertain environment, careful security selection will be critical. "Skilled active management can help investors avoid riskier exposures," Page argues.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.