Highlights

- European-domiciled ETFs saw total net inflows of $10 billion in September, down from the $11.1 billion in the previous month1.

- Equity products saw net inflows of $7.8 billion while fixed income strategies attracted just under $2 billion.

- Commodity ETFs generated inflows of $253.9 million, while multi-asset products saw inflows of $24.6 million. Alternatives strategies attracted $12.7 million.

Total ETF market flows

Bond inflows softened in September

European ETF cumulative flows - cumulative 12 months by asset class ($ billion)

.png)

Source : ETFBook, as at 30 September 2023.

Equity ETFs

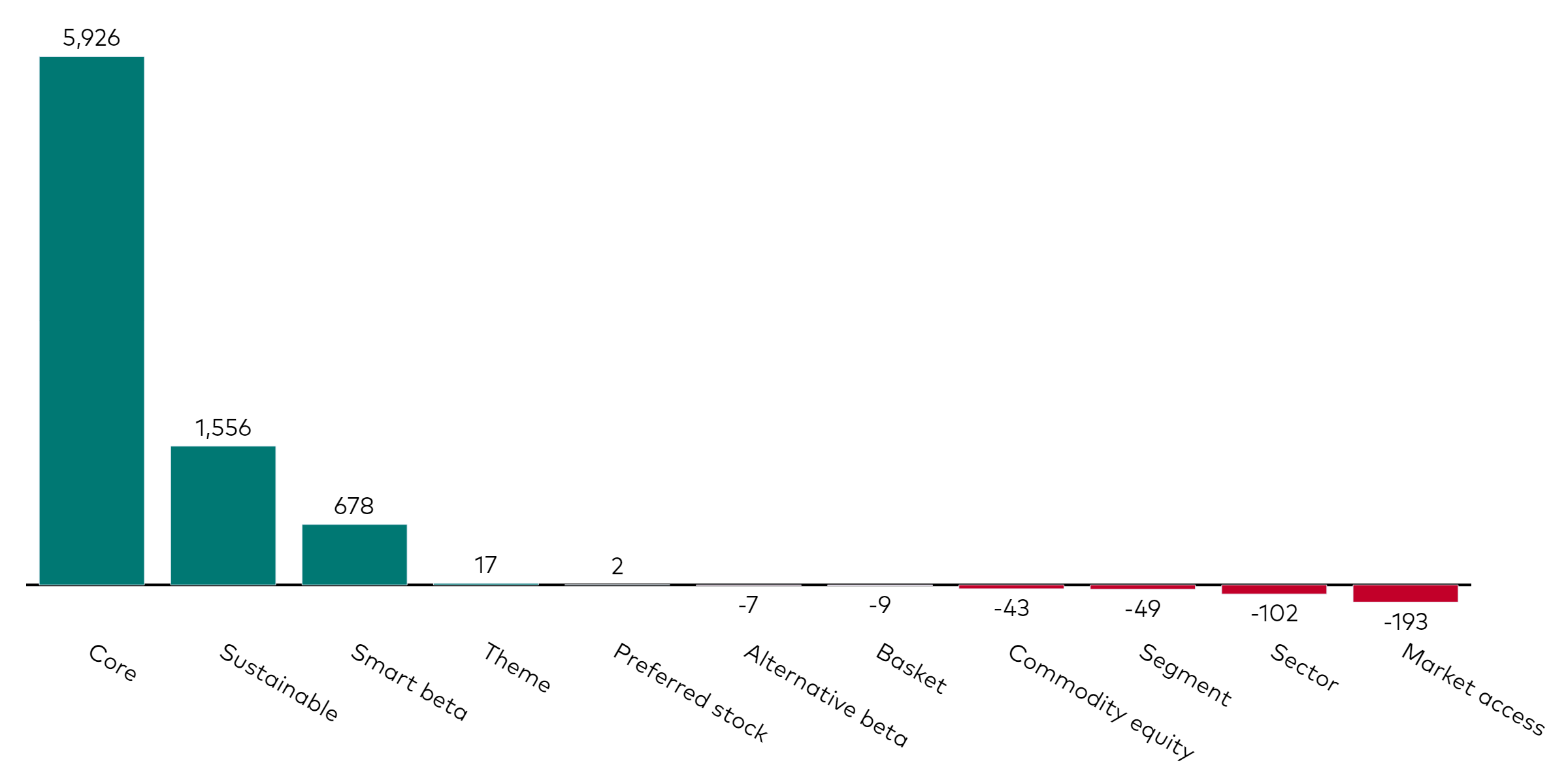

Core equity remains most popular equity ETF category

Equity flows by category: Month to date ($ million)

Source: ETFBook, as at 30 September 2023. The ‘segment' category includes equity exposures which target specific market capitalisation segments, such as small-cap, mid-cap and large-cap. The ‘market access' category includes difficult-to-access markets such as emerging markets. The ‘basket' category includes strategies that combine several stocks as the underlying exposure, such as FAANG stocks.

Core equity ETFs were again the top contributor in September, adding $5.9 billion to net inflows. Sustainable equity strategies were the second-most popular category, garnering $1.6 billion in net inflows. Meanwhile, difficult-to-access market strategies saw -$193 million of net outflows during the month.

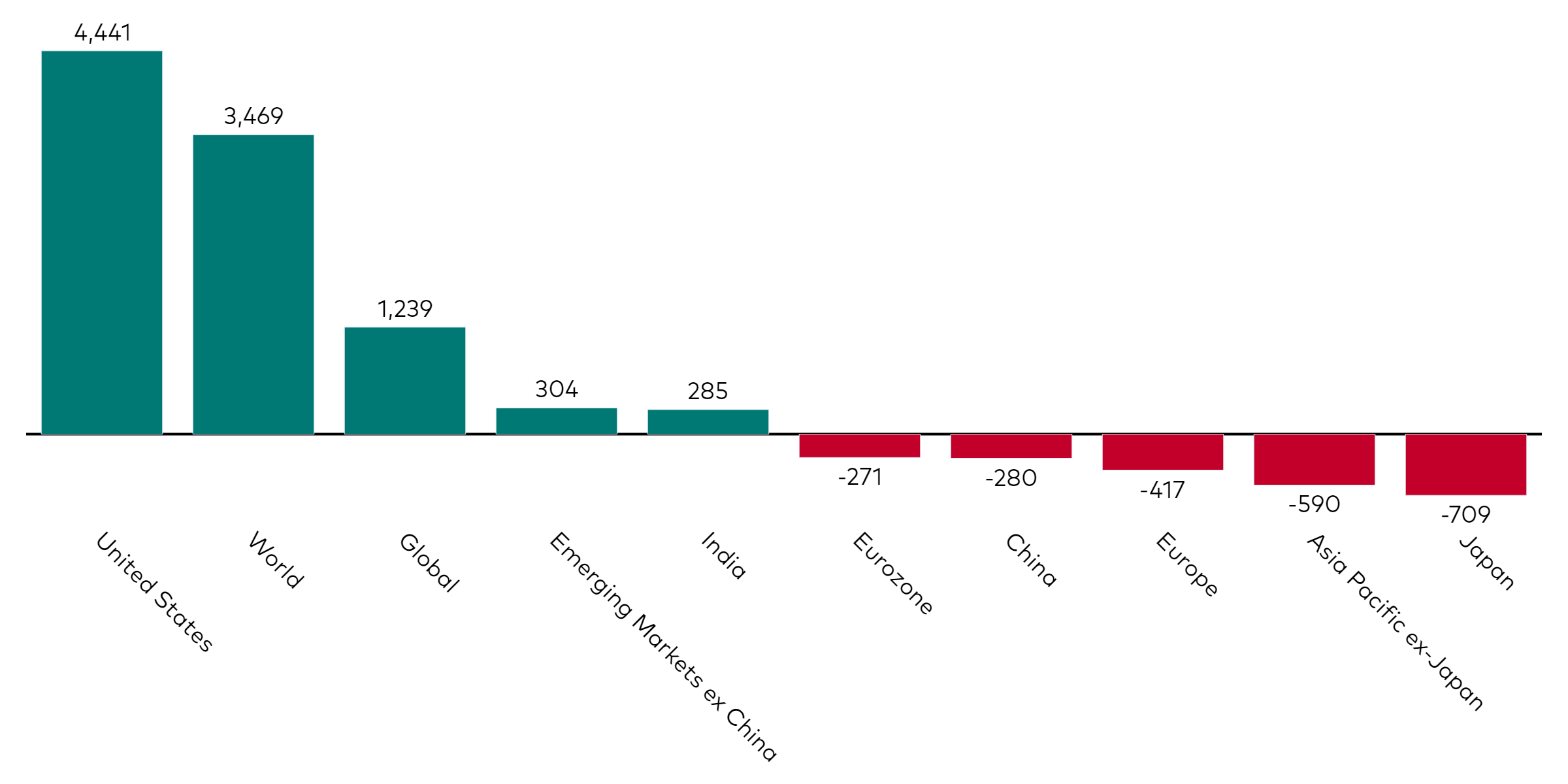

Investors favour US equity exposures

Equity flows by geographic exposure: Month to date ($ million)

Source : ETFBook, as at 30 September 2023.

United States exposures ($4.4 billion) attracted the most inflows within equity ETFs, followed by World (which doesn't include emerging markets) ETFs, which saw $3.5 billion in net inflows. Japanese equity ETFs were the least popular category, seeing -$708.6 million in net outflows.

Fixed income ETFs

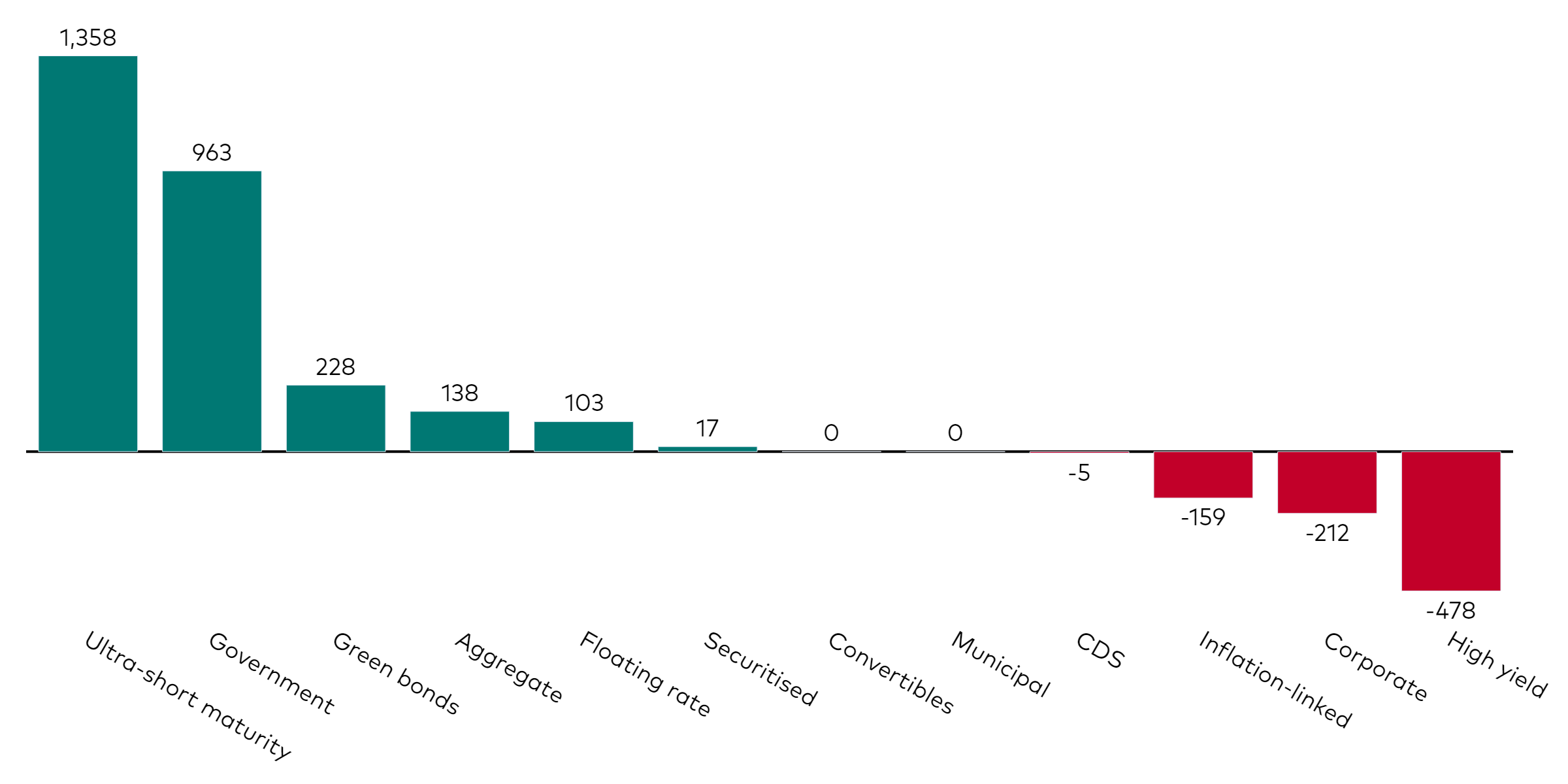

Ultra-short maturity bond ETFs still most popular

Fixed income flows by category: Month to date ($ million)

Source : ETFBook, as at 30 September 2023.

Ultra-short maturity bond ETFs2 ($1.4 billion) remained the biggest contributors to net fixed income inflows, despite dropping off considerably from the previous month ($2.5 billion inflows). Government bond ETFs ($963.1 million) also saw strong inflows, while high yield bond products saw the largest outflows (-$478.4 million).

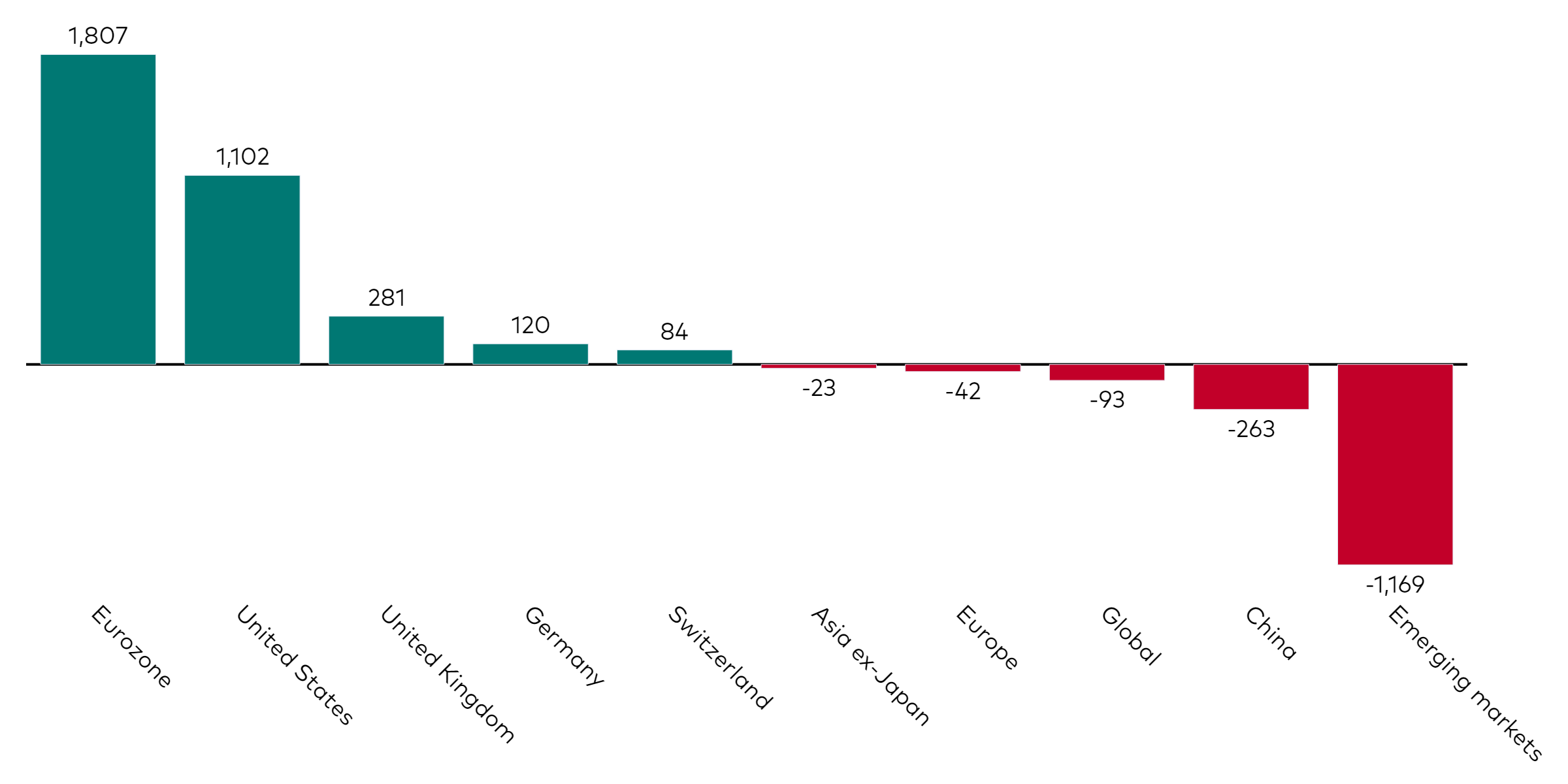

Eurozone bond exposures oust US as top region

Fixed income flows by geographic exposure: Month to date ($ million)

Source : ETFBook, as at 30 September 2023.

Eurozone bond exposures ousted the US as the top regional contributor across fixed income ETFs, with $1.8 billion of net inflows in September, followed by US bond ETFs with $1.1 billion. Meanwhile, emerging market bond ETFs continued to see the largest net outflows, with -$1.2 billion.

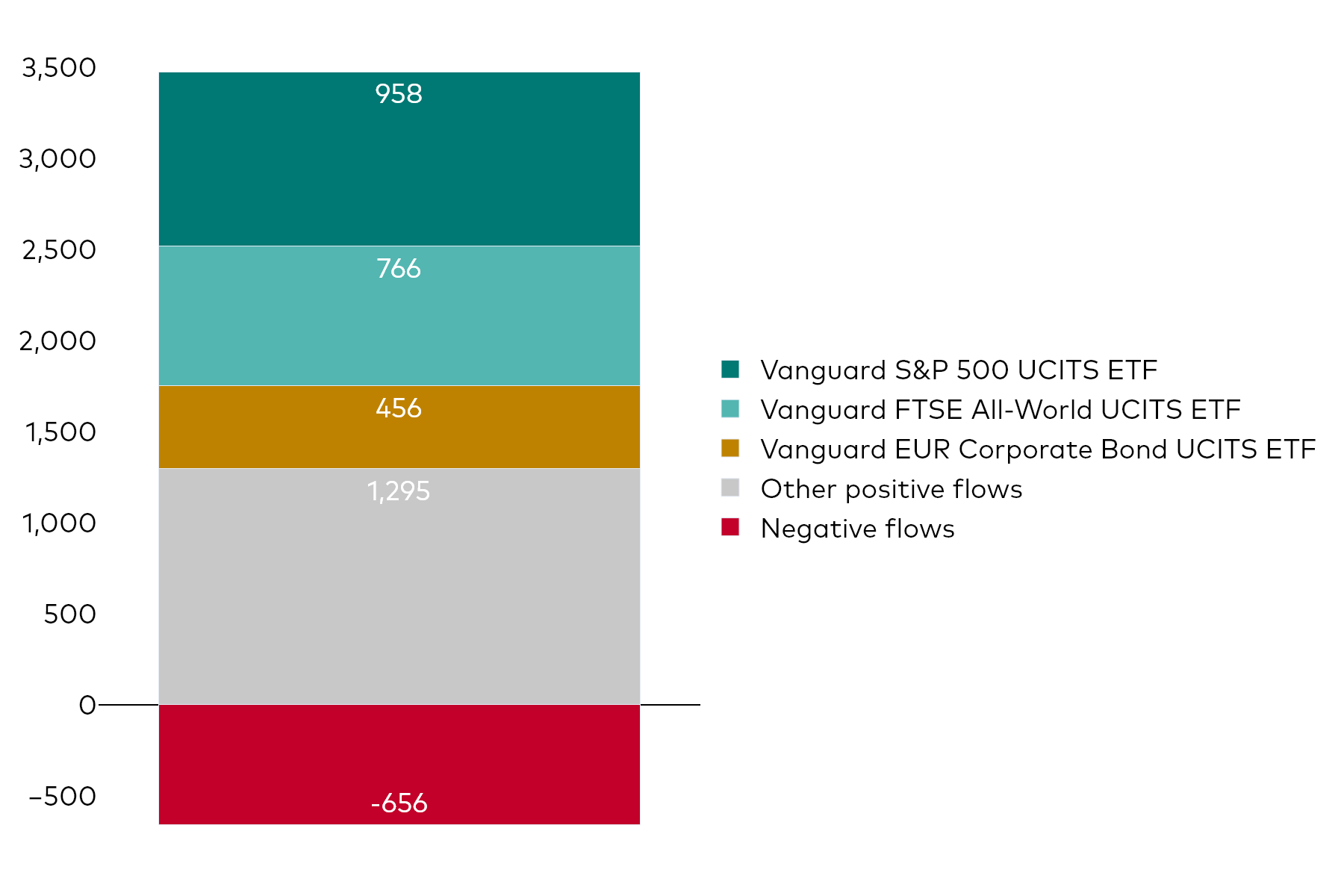

Vanguard UCITS ETFs

Vanguard range sees net inflows of $1.6 billion in September

Vanguard UCITS ETF net flows: Month to date ($ million)

Source : ETFBook, as at 30 September 2023.

The Vanguard UCITS ETF range captured net inflows of $1.6 billion, with the majority of Vanguard UCITS ETFs recording positive flows. Flows were split between Vanguard's equity UCITS ETF range ($1.2 bllion), fixed income UCITS ETF range ($457 million) and multi-asset UCITS ETF range ($13 million).

Our most-popular ETFs in September

FTSE All-World UCITS ETF - (USD) Accumulating (VWRP)

S&P 500 UCITS ETF - (USD) Accumulating (VUAG)

EUR Eurozone Government Bond UCITS ETF - (EUR) Accumulating (VETA)

Exchange-traded funds

Low-cost, uncomplicated portfolio building blocks

1 Source: ETFBook, as at 30 September.

2 Source: ETFBook, as at 30 September 2023. The ultra-short category includes ETFs that invest in fixed income instruments with very short-term maturities.

Important risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

Investments in smaller companies may be more volatile than investments in well-established blue chip companies.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid- offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

For further information on risks please see the "Risk Factors" section of the prospectus.

Important information

This is a marketing communication.

For professional investors only (as defined under the MiFID II Directive) investing for their own account (including management companies (fund of funds) and professional clients investing on behalf of their discretionary clients). In Switzerland for professional investors only. Not to be distributed to the public.

For further information on the fund's investment policies and risks, please refer to the prospectus of the UCITS and to the KIID (for UK, Channel Islands, Isle of Man investors) and to the KID (for European investors) before making any final investment decisions. The KIID and KID for this fund are available in local languages, alongside the prospectus.

The information contained in this document is not to be regarded as an offer to buy or sell or the solicitation of any offer to buy or sell securities in any jurisdiction where such an offer or solicitation is against the law, or to anyone to whom it is unlawful to make such an offer or solicitation, or if the person making the offer or solicitation is not qualified to do so. The information in this document is general in nature and does not constitute legal, tax, or investment advice. Potential investors are urged to consult their professional advisers on the implications of making an investment in, holding or disposing of shares and /or units of, and the receipt of distribution from any investment.

For Swiss professional investors: Potential investors will not benefit from the protection of the FinSA on assessing appropriateness and suitability.

Vanguard Funds plc has been authorised by the Central Bank of Ireland as a UCITS and has been registered for public distribution in certain EEA countries and the UK. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisers on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Asset Management, Limited is a distributor for Vanguard Funds plc.

The Manager of the Ireland domiciled funds may determine to terminate any arrangements made for marketing the shares in one or more jurisdictions in accordance with the UCITS Directive, as may be amended from time-to-time.

The Indicative Net Asset Value ("iNAV") for Vanguard's ETFs is published on Bloomberg or Reuters. Refer to the Portfolio Holdings Policy.

For investors in Ireland domiciled funds, a summary of investor. It is available in English, German, French, Spanish, Dutch and Italian.

London Stock Exchange Group companies include FTSE International Limited ("FTSE"), Frank Russell Company ("Russell"), MTS Next Limited ("MTS"), and FTSE TMX Global Debt Capital Markets Inc. ("FTSE TMX"). All rights reserved. "FTSE®", "Russell®", "MTS®", "FTSE TMX®" and "FTSE Russell" and other service marks and trademarks related to the FTSE or Russell indexes are trademarks of the London Stock Exchange Group companies and are used by FTSE, MTS, FTSE TMX and Russell under licence. All information is provided for information purposes only. No responsibility or liability can be accepted by the London Stock Exchange Group companies nor its licensors for any errors or for any loss from use of this publication. Neither the London Stock Exchange Group companies nor any of its licensors make any claim, prediction, warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the FTSE or Russell indexes or the fitness or suitability of the indexes for any particular purpose to which they might be put.

The index is a product of S&P Dow Jones Indices LLC ("SPDJI"), and has been licensed for use by Vanguard. Standard & Poor's® and S&P® are registered trademarks of Standard & Poor's Financial Services LLC ("S&P"); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones"); S&P® and S&P 500® are trademarks of S&P; and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Vanguard. Vanguard product(s) are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, or their respective affiliates and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the index.

For Dutch investors only: The fund(s) referred to in this document are listed in the AFM register as defined in section 1:107 Dutch Financial Supervision Act (Wet op het financieel toezicht). For details of the Risk indicator for each fund listed in this document, please see the fact sheet(s).

For Swiss professional investors: The Manager of Vanguard Funds plc is Vanguard Group (Ireland) Limited. Vanguard Investments Switzerland GmbH is a financial services provider, providing services in the form of purchase and sales according to Art. 3 (c)(1) FinSA. Vanguard Investments Switzerland GmbH will not perform any appropriateness or suitability assessment. Furthermore, Vanguard Investments Switzerland GmbH does not provide any services in the form of advice. Vanguard Funds Series plc has been authorised by the Central Bank of Ireland as a UCITS. Prospective investors are referred to the Funds' prospectus for further information. Prospective investors are also urged to consult their own professional advisors on the implications of making an investment in, and holding or disposing shares of the Funds and the receipt of distributions with respect to such shares under the law of the countries in which they are liable to taxation.

Vanguard Funds plc* has been approved for offer in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). The information provided herein does not constitute an offer of [Vanguard Investment Series plc/Vanguard Funds plc]* in Switzerland pursuant to FinSA and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for [Vanguard Investment Series plc/Vanguard Funds plc]*. The Representative and the Paying Agent in Switzerland is BNP Paribas Securities Services, Paris, succursale de Zurich, Selnaustrasse 16, 8002 Zurich. Copies of the Articles of Incorporation, KIID, Prospectus, Declaration of Trust, By-Laws, Annual Report and Semiannual Report for these funds can be obtained free of charge from the Swiss Representative or from Vanguard Investments Switzerland GmbH.

Issued in EEA by Vanguard Group (Ireland) Limited which is regulated in Ireland by the Central Bank of Ireland.

Issued by Vanguard Asset Management, Limited which is authorised and regulated in the UK by the Financial Conduct Authority.

Issued in Switzerland by Vanguard Investments Switzerland GmbH.

© 2023 Vanguard Group (Ireland) Limited. All rights reserved.

© 2023 Vanguard Investments Switzerland GmbH. All rights reserved.

© 2023 Vanguard Asset Management, Limited. All rights reserved.