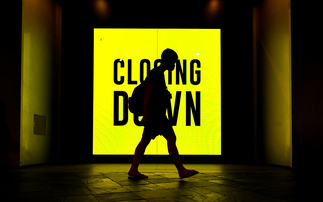

Open-ended property funds offering investors daily liquidity are an "aberration", according to Jean-Philippe Blua, head of investment risk and performance at BlueBay Asset Management, who described the fund structure as "an accident waiting to happen".

"It does not make any sense whatsoever. I am still sort of gobsmacked that this could have existed up until now," Blua said. "Anyone who is trying to buy or sell a property knows that is absolutely impossible to be consistent with getting your money back within a day." Open-ended property funds across the industry have been suspended since March due to liquidity issues arising from the Royal Institute of Chartered Surveyors (RICS) imposing a material valuation uncertainty clause across the market in the wake of the coronavirus pandemic. On 9 September, RICS removed that clause acro...

To continue reading this article...

Join Investment Week for free

- Unlimited access to real-time news, analysis and opinion from the investment industry, including the Sustainable Hub covering fund news from the ESG space

- Get ahead of regulatory and technological changes affecting fund management

- Important and breaking news stories selected by the editors delivered straight to your inbox each day

- Weekly members-only newsletter with exclusive opinion pieces from leading industry experts

- Be the first to hear about our extensive events schedule and awards programmes