Stephen Yiu

You would be forgiven for thinking you were walking into a tech start-up when you entered the offices of Blue Whale on Grosvenor Street.

With an average age of 35, and the fund manager Stephen Yiu the eldest at 43 years old, the staff get to their desks by 7:30am, hungry to show incumbent asset management firms they have what it takes to deliver the best returns for their investors.

Having only arrived on the asset management scene in 2016, the firm has been quick to prove itself, surpassing £1bn in assets under management by September this year.

No second fund on the horizon for Blue Whale but a trust could happen

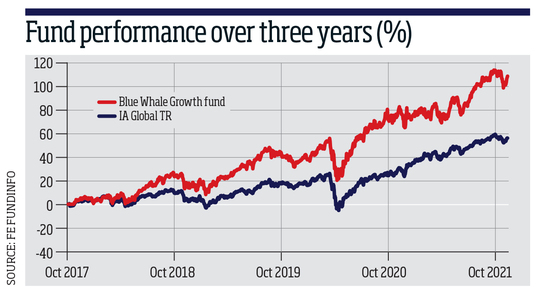

Since its inception in September 2017, the fund has returned 107.1% while the Investment Association Global sector has returned 56%, according to FE fundinfo.

Yiu firmly expects that "experienced youth" plays a key role in the success of the firm.

"If you are overly experienced, you really believe your experience counts more than the market suggests," he says.

The founder of Blue Whale thinks managers can be particularly blind when it comes to the FTSE.

At the moment, the market cap of Microsoft is about $2trn, which is "roughly the same size as the UK stockmarket," he says.

He has seen commentary that this means Microsoft must be overvalued and the UK stockmarket is undervalued.

"That is crazy," he says, waving his hands in dismay. "Maybe if you made this comment 20 years ago I would believe you, but it can't be true today."

The former UK fund manager explained European companies, including UK companies, missed out on "cheap changes" and therefore are not as valuable as some of the US technology companies. Microsoft sits in Yiu's top ten, which collectively makes up 50.4% of the portfolio, and it is a company he passionately believes has the recipe for success.

Sitting on Teams, he explains this year the company is increasing the price of its Office 365 products by 15% to 20% across the board, including Teams.

"Your employer is going to pay 15% to 20% more this time next year for you to continue to use Teams and Outlook. If you tell me the UK stockmarket on a combined basis can do that, then I will agree with you I should sell Microsoft now and invest in the FTSE 100."

He goes on to add that Microsoft is not increasing its prices because of inflation as it has no "input costs", it is simply increasing its profit margin. Meanwhile, FTSE companies such as Unilever and Nestlé are suffering from inflationary costs but are struggling to pass them onto consumers.

Market efficiency

While Yiu is considered young by industry terms, he challenges this characterisation of himself and says "he is not that new" to the industry, having been around for 20 years.

Following a degree in engineering and a background in computing, at 22 Yiu joined Hargreaves Lansdown and has not looked back.

"This is something that I do enjoy…it is still keeping me awake every day and I want to get to work as soon as I can. I think it is the challenges," Yiu explains.

One of the challenges that Yiu clearly spends a lot of time thinking about is the "efficiency of the market".

Yiu believes the recognition of this challenge has given Blue Whale an edge and is causing hard times for fund managers that are refusing to change their investment processes.

He said that at the beginning of his career he "would have used sell side research extensively".

"[At that time] you did not need to do your own research. You can just have some good contacts on the sell side banks and then you can actually generate alpha," Yiu explained.

Value investing is dead: Peter Hargreaves' stark prediction for 2021

However, times have changed, with technology and regulation, meaning the dissemination of that research is swift and vast.

As a result, Yiu sees "very little value" in sell-side research and speaking to sales analysts. Instead, he demands his teams do all the research from scratch.

"The market regime has changed and I think your approach needs to evolve with this," the fund manager says.

Even so, many of his competitors "refuse to acknowledge" this and are still using the approach that used to work for them, according to Yiu.

This obviously has an impact on performance, but without anyone there to challenge the stalwarts, there is no fall-out and that is a problem, Yiu says.

Wanted: Blossoming boutiques

It is for this reason that he is a fan of ETFs, which he believes will make the industry "healthier" by putting pressure on managers and firms that are not returning above the index.

However, he is worried about the challenges new firms face when looking to breakthrough the stiff boundaries set by the asset management industry.

A Freedom of Information request submitted by Investment Week to the Financial Conduct Authority (FCA) shows there were 97 newly authorised asset management firms last year, while in 2016 there were 221.

The co-founder of Blue Whale feels it is imperative to have new firms join the industry, adding it is not regulation that is holding them back.

It is the "network of relationships that have been built up over many, many years".

"Obviously, I would see myself as someone who is very hardworking, someone who is really committed, but if I started this journey on my own, I think I would be lucky to be running £200m now," he says.

Yiu puts enormous weight on the vote of confidence given by Peter Hargreaves, who helped launch the Blue Whale Growth fund by seeding it with his money.

Since then, he has been upping his stake and in July it was reported that he had just under a quarter of the total assets.

"I think for anyone who wants to start by themselves it would be quite difficult," Yiu says.

On top of this there is significant consolidation in the industry, with 1,071 deals in the past ten years, according to Refinitiv figures.

Consolidation makes it challenging for boutiques because as firms come together, they can add to their bottom line and grow their assets, but for a boutique to grow its assets it simply must attract more investors, the manager said.

However, there is an upside to all this activity in the asset management industry.

It means some investors are craving stability and with a younger firm, with a passionate fund manager, Blue Whale and Yiu in particular expect to be running money for another 20 years.