Industry Voice: Hans Peter Portner, Head of Thematic Equities at Pictet Asset Management, reveals what makes a good thematic equity investment

A global 'mis-step' and a lesson learned

In the mid-1990s, while working for another asset management company early in my investment career, I was given the responsibility of managing the global equity segment of a pension fund. Until then I had only run single country portfolios so it was an exciting opportunity for me.

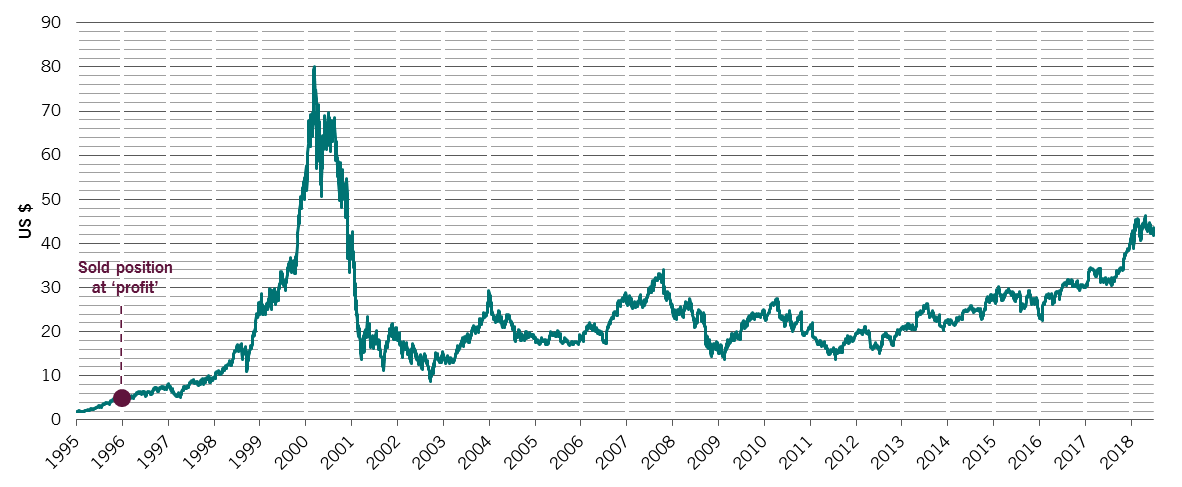

Among the stocks I inherited was a new technology hardware manufacturer. It was increasing sales rapidly but I couldn't really understand the business fundamentals or its long-term appeal. After some months of strong share price performance I decided to take profits on the stock and sold it.

That, unfortunately, proved a little premature (to say the least). In the following five years, the company's share price continued on a stratospheric path. While falling heavily in the dot-com bust, it ultimately emerged on the other side to become a mainstay in global equity indices. Today, the firm boasts a market capitalisation of USD200 billion and employs over 70,000 people. The stock I unwisely sold was Cisco Systems, a behemoth of the Internet age.

SHARE PRICE OF CISCO 1995-2018

Source: Bloomberg, July 2018

From this experience I learnt that when it comes to investing in global equities, it pays to become a specialist. Being a portfolio manager that takes recommendations from a pool of sector analysts can lead to poor decisions. By accumulating expertise in a specific sector, however, investment managers are, I believe, better positioned to deliver clients repeatable outperformance over the long term.

I also learnt that the world was changing faster than ever and that being on the wrong side of change could have massive repercussions for investment portfolios. More specifically, I discovered that I should view the world through the prism of 'megatrends' - the technological, environmental and societal forces of change that were giving rise to compelling investment opportunities in specific industries. In the case of Cisco, I failed to appreciate the pace of technological development and the rapid evolution of the network economy.

Our thematic platform

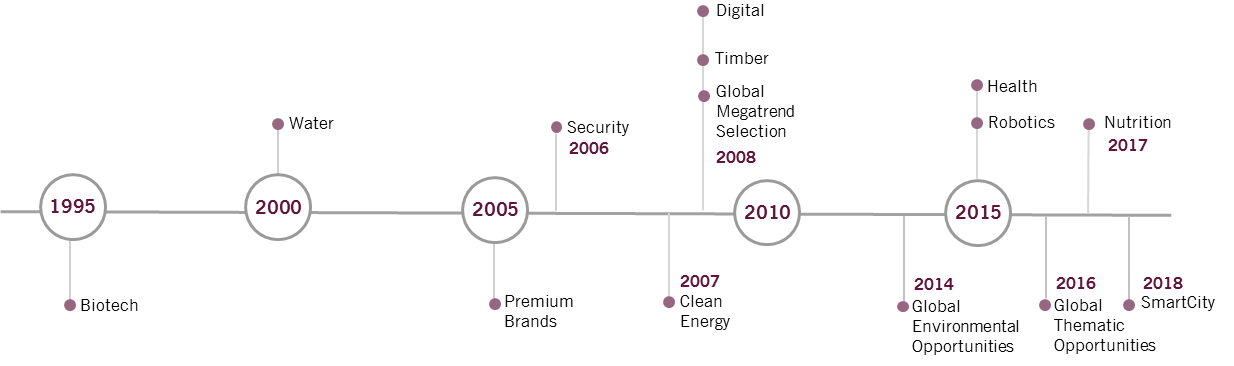

It is by applying these two lessons consistently over more than two decades that I and my colleagues at Pictet Asset Management have been able to build unrivalled expertise in thematic equities. We now manage over USD 40 billion in equity assets across a range of single-theme and multiple-theme strategies, each one designed to take advantage of the long-term trends transforming the economic landscape.

PICTET ASSET MANAGEMENT THEMATIC STRATEGIES

Source: Pictet Asset Management, 2018

The firms we invest in our thematic portfolios have several distinguishing features. First, thematic companies operate in the most dynamic areas of the economy - sectors whose prospects are being transformed by megatrends.

Second, they are specialists. We concentrate investments in specialist companies whose revenue growth is tied to the evolution of a particular theme, which we measure with our proprietary gauge of thematic "purity". This is because we are mindful of avoiding the ‘conglomerate discount' - a valuation penalty that's applied to larger, more complicated businesses.

Third, the companies we invest in have underappreciated cash generation capabilities. Our research shows that the market persistently overestimates how quickly the cash flow of these companies fades: an anomaly that we aim to exploit.

'Knowing everything about little'

Our ability to identify such distinctive investments stems from our own specialist expertise. Our investment managers are specialists in the themes they manage. They are definitely not generalists but very focused investors. We like to say they "know a lot about little", combining the role of both analyst and portfolio manager.

Teamwork is crucial, so we ensure each portfolios is overseen by at least two investment managers. A rigorous investment process is essential too. A commonly agreed process provides the arena for clear debate and sound decision making.

Hans-Peter Portner speaking at Pictet Asset Management's Reaching Higher Ground Conference

Source: Magnus Arrevad Photography

Future proofing

What also sets our thematic equity franchise apart is our use of external experts - or Advisory Boards - for each of our single-theme strategies to help us track and manage the evolution of investment themes.

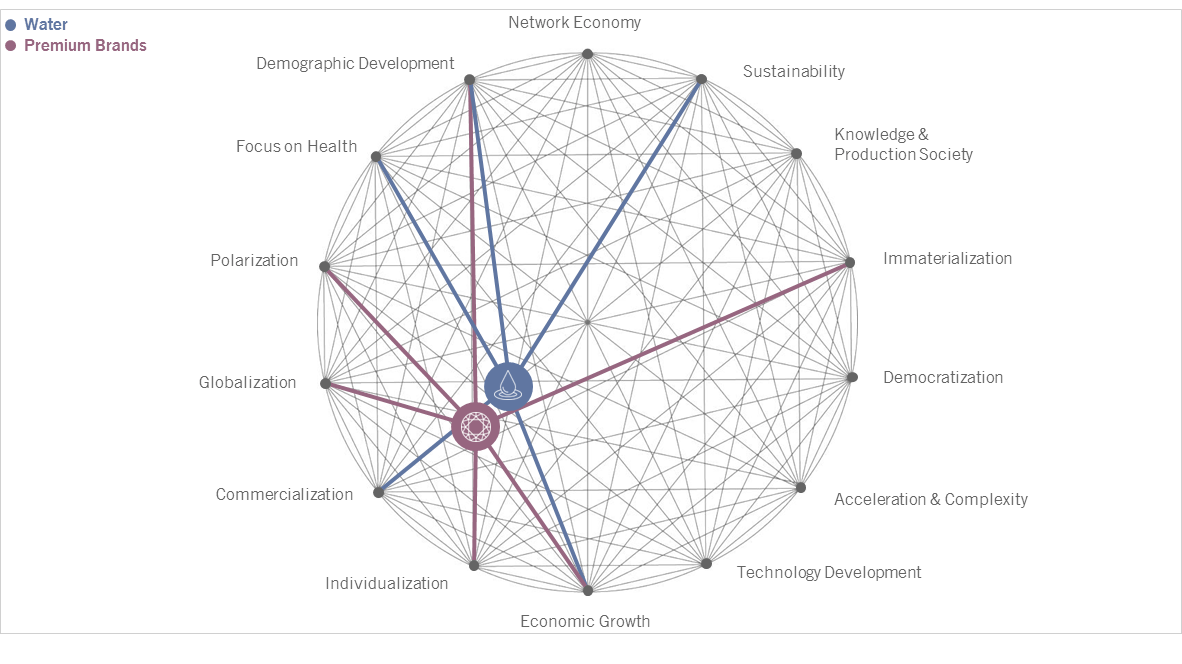

These boards do not dictate the construction of portfolios; rather, they help our investment managers track and assess the long-term course of the theme. We also work with the Copenhagen Institute for Future Studies (CIFS) whose megatrend framework we use as a ‘lens' through which to analyse the evolution of our investment universe. Click here to read more about our advisory boards in an interview with my colleague, Philippe Rohner.

OUR THEMES SIT AT THE INTERSECTION OF MEGATRENDS

Source: Pictet Asset Management, Copenhagen Institute for Futures Studies

Portfolios for professional investors

Over the past several years, we have developed two multiple-theme strategies that we believe can fit in the active equity allocation of institutional portfolios: Pictet Global Thematic Opportunities (GTO) and Pictet Global Environmental Opportunities (GEO). You can find out more about them here.

Both strategies are benchmark agnostic and genuinely active, with a high active share and high conviction in their approach. Tracking their performance versus a market index in the shorter term is a bit limiting, but in the long term they should benefit from not having to cleave to a backward-looking index of past winners.

Our entire thematic process is built on identifying the Ciscos of the future, and we remain confident that our approach leaves us well placed to outperform the main global equity indices over the long term.

DISCLOSURES

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund's prospectus, KIID (Key Investor Information Document), regulations, annual and semi-annual reports may be relied upon as the basis for investment decisions. These documents are available on assetmanagement.pictet or at Pictet Asset Management (Europe) S.A., 15, avenue J. F. Kennedy, L-1855 Luxembourg.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Risk factors are listed in the fund's prospectus and are not intended to be reproduced in full in this document.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. This marketing material is not intended to be a substitute for the fund's full documentation or any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

This article was a paid posting by Pictet Asset Management all views and/or opinions are those of the sponsor and not of Investment Week.