Technology holds the key to resolving the world's growing water shortage problems. Thematic investors can make the most of the opportunity.

A quarter of a per cent. That's how much of the world's water is usable. The rest is too salty, too polluted or frozen. As the globe's population grows and its middle class swells1, the pressure on this vital but scarce resource is intensifying. By 2030, our planet will face a 40 per cent shortfall in fresh water supply, according to UNESCO.

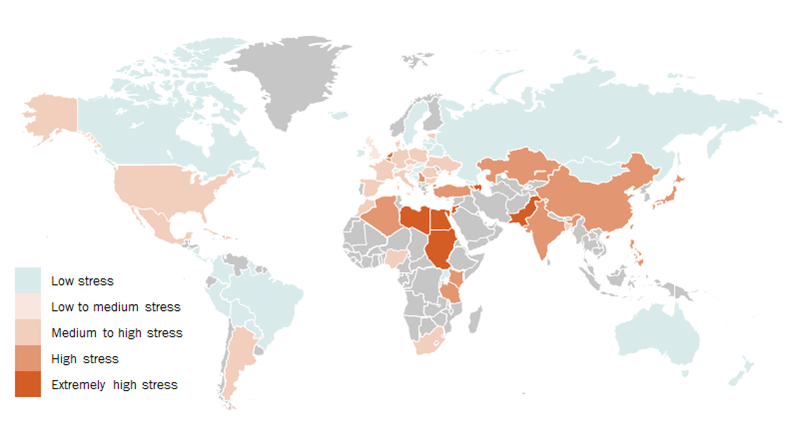

WATER STRESS

Freshwater withdrawals as a share of internal resources

Total water withdrawals from agriculture, industry and municipal/domestic uses. Source: UN Food and Agriculture Organization, Our World in Data; data covering 2012-2014.

We clearly need to make water go further. That means consuming less, recycling more and tapping into currently unusable reserves.

Achieving this requires investment from both the public and private sectors, education programmes across all ages and we need technology and innovation to improve the productivity of water as a resource. Pictet Asset Management's Water strategy is particularly focused on the contribution investment and technology can make.

Using less

Agriculture is a top target for the water technology, given that it is by far the biggest user of the liquid. It accounts for 70 per cent of the total global consumption of some 5,000 cubic km each year.

GROWING THIRST

Global freshwater use (trillion cubic metres)

Source: Global International Geosphere-Biosphere Programme (IGB), Our World in Data. Data covering period 01.01.1901-31.01.2014.

Precision irrigation is one of the innovations aiming to preserve the precious water resource both by cutting agriculture's consumption of the liquid and by lowering the required amount of fungicides, herbicides and pesticides - which in turn reduces water pollution.

New sensor-based IoT technology, for example, can determine exactly when water is needed and in what quantity. This both cuts water consumption and increases the crop yield.

On a smaller scale, smart sprinklers, controlled via a mobile phone app, can reduce water use in domestic gardens. These technologies are already big business. The global micro-irrigation systems market is expected to more than triple to USD14.9 billion by 2025.2

Recycling more

As well as using less water, we need to recycle more. Private sector companies are alert to the challenge, with the global waste water recycling market growing at 20 per cent a year. Here, the biggest technological problem is removing micro-pollutants, which can cause health and environmental problems. If we can clean it, however, wastewater becomes a great resource.

Thanks to advances in analytical chemistry, we can now measure concentrations down to parts per trillion - the equivalent of one drop of impurity in 500,000 barrels of water. That gives a much greater degree of confidence in the quality of treated water - even opening up the door to recycled water being fit for human consumption rather than just for industrial use.

New lease of life

Innovation is needed not just to create new systems but to preserve old ones. Ageing infrastructure is a major problem. In the US alone, 1.7 trillion gallons of treated drinking water are lost as a result of leaks each year, at a cost of USD2.6 billion. Technology can help locate trouble-spots more quickly, giving a new lease of life to old pipes.3

Smart water meters can often be the first port of call as they will pick up on changes in water use. In Barcelona, for example, smart meter customers are notified by email or telephone when higher consumption or leakages are detected. This has helped the city to cut its per capita water use by a fifth.4

For maximum effect, the data from smart meters needs to be amalgamated, combined with information from other sensors and then analysed to identify any existing or future problems. That's where companies like Singapore-based Visenti come in. Visenti's IoT platform can manage data on flow rates, total volume, pressure and water quality, providing real-time information and sending alerts in case of any anomalies.

Robotic network inspectors, such as those designed by Pure Technologies, are another line of defence, particularly in expensive large-diameter pipes. The Xylem-owned company has also developed the free-swimming SmartBall which can measure acoustic activity to detect leaks.5

Together, these established technologies - and new ones currently in development - can help us ensure that there is enough clean water in the world. As investors, we have the opportunity to be at the forefront of this new and rapidly growing tide.[2] Inkwood Research, 2017

[3] US Environmental Protection Agency

DISCLOSURES

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund's prospectus, KIID (Key Investor Information Document), regulations, annual and semi-annual reports may be relied upon as the basis for investment decisions. These documents are available on assetmanagement.pictet or at Pictet Asset Management (Europe) S.A., 15, avenue J. F. Kennedy, L-1855 Luxembourg.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Risk factors are listed in the fund's prospectus and are not intended to be reproduced in full in this document.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. This marketing material is not intended to be a substitute for the fund's full documentation or any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

This article was a paid posting by Pictet Asset Management all views and/or opinions are those of the sponsor and not of Investment Week.