In the IA Global sector, only eight funds out of more than 500 avoided making a loss, with the average day-to-day return between 2 August and 12 August being -2.56%, according to data from Morningstar Direct.

The VT De Lisle America, abrdn North American Small & Mid-Cap Equity and WisdomTree’s Blockchain UCITS ETF funds were some of the heaviest sufferers in their respective sectors of last week’s global market turmoil.

As stocks and indices plummeted on Monday (5 August) last week, traders and managers braced themselves to tussle with one of the most volatile trading days since pre-pandemic paranoia.

"Today is going to be carnage," one City trader told Investment Week as he walked into his office. Fast forward just over a week and the picture looks a little different — one more of market stability than severe volatility following a bounce, as fund managers worked to recoup their losses.

Markets remain vulnerable to unwinding of yen 'carry trade'

In the IA Global sector, only eight funds out of more than 500 managed to avoid making a loss, with the average day-to-day return between 2 August and 12 August standing at -2.5%, according to data from Morningstar Direct.

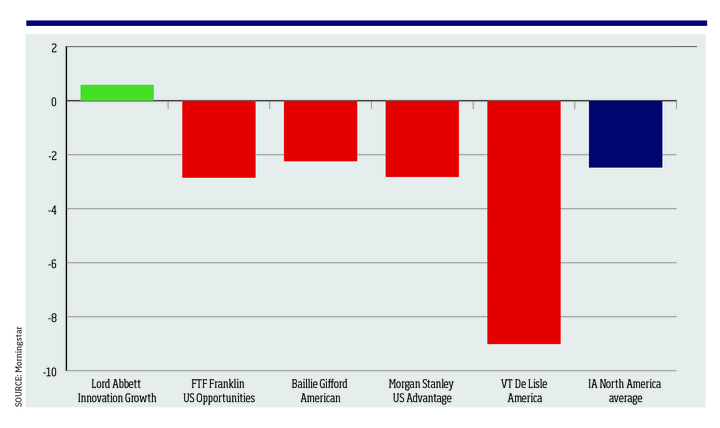

IA North America funds painted a similar picture, with just four of 256 in the black over the ten days and recording an average loss of 2.5%.

The winners and losers

Lord Abbett's Innovation Growth fund topped the IA North America table with a 0.6% gain, while on the IA Global side, the Valu-Trac Price Value Portfolio returned 1.3%. Both funds are active rather than passive.

As the market was thrown off kilter and managers attempted to mop up the mess made by Black Monday, the four biggest casualties of the IA Global sector were all passive.

These were the WisdomTree Blockchain UCITS ETF; Invesco CoinShares Global Blockchain UCITS ETF; WisdomTree Battery Solutions UCITS ETF and L&G Battery Value-Chain UCITS ETF. The four ETFs lost 11.4%, 8.6%, 7.6% and 7.5%, respectively, over the ten-day period.

IA Global sector shows ETF losses

US recession overtakes geopolitical conflict as top tail risk for global investors

The De Lisle America fund performed worst in the IA North America sector at -9%, a significant drop of over -2.5% from the fund that incurred the second-largest losses. However, manager Richard de Lisle said the net effect over the whole period is "essentially neutral" for the fund.

He noted the sell-off came off the back of an "equally rapid move upwards" only a few weeks ago, when the news of falling US inflation on 11 July led the fund to rally around 10% over the following week, as the market's expectations for falling rates were boosted.

"The fund is now essentially back to where it started before 11 July CPI," de Lisle said. "So, although the -9.01% move is large relative to the IA North America sector, it should be viewed in context of the move up."

De Lisle America was the worst performer

Friday Briefing: Bad news is bad news once again

However, nestled in the data was a story of funds that weathered the storm and managed to clock near-average sector returns despite experiencing some of the highest levels of volatility of any funds.

Cumulative standard deviation data, which looks at the total volatility over this ten-day period, averaged at 1.1% across IA Global funds.

Blue Whale's Growth fund, managed by Stephen Yiu, eclipsed this volatility reading, clocking in 2.9% volatility with a loss of -5.2%, some of which the fund has since made back this week.

Yiu told Investment Week that last week represented an "indiscriminate sell-off, which had nothing to do with the fundamental earnings power of a company".

BUY BUY BUY

On Black Monday, as Nvidia's share price toppled to below $100 for the first time since May this year, Yiu bought shares at the open for $95.

"We actually took the opportunity to increase the position at $95 and look at the price now. I think it is about $115/$120 just within a week," said Yiu.

Lots of retail investors "just want to buy things that go up, so when things come down, they sell", he added. "We have made 20% within a week. So as fundamental base, high conviction, active managers, we actually like volatility."

Friday Briefing: A US recession was never really off the table

While the concentrated nature and active management of Blue Whale's Growth fund helped it avoid significant losses, Grant Bowers, portfolio manager of the FTF Franklin US Opportunities fund, said that "diversification helped us to mitigate some of the downside volatility experienced".

Baillie Gifford's American fund, meanwhile, recorded 2.34% volatility compared to the IA North America average of 1.16% but outperformed the sector average with a loss of just 2.24% compared to the 2.47% mean.

It was a similar story for the company's Positive Change fund, which shed less than 1% despite eclipsing the volatility average by almost a whole percentage point.

US inflation dips below 3% for the first time since 2021

"The concentrated, high-conviction nature of the portfolio means that volatility is consistently higher than the benchmark," said Baillie Gifford's investment specialist Rosie Rankin.

"During periods of short-term market volatility, the positive change team stay true to our long-term growth philosophy and dual objectives."

Morgan Stanley's US advantage fund experienced a tumultuous 3.2% volatility, the highest in the IA North America group, but lost just 2.17%.

With whispers of further changes to interest rates and geopolitical uncertainty around the corner, managers and traders remain braced for opportunity within the upheaval.