HM Treasury’s regulatory roadmap towards tackling greenwashing will likely reinvigorate the asset management industry from an “ESG and responsible investment coma,” according to industry commentators and legal experts, who have reacted to the report with a “mix of excitement and cautious optimism”.

However, they warn the new legislation may present further challenges, including data overload, additional work for fund groups and even a dual fund system, emphasising that the roadmap must transcend being an initiative "just ahead of COP26 to boost media coverage".

Last week (18 October), Chancellor Rishi Sunak published a roadmap setting out the Treasury's new Sustainability Disclosure Requirements (SDR), which were initially announced in July this year. The requirements, which will affect asset managers, investment products and listed corporates, require firms to disclose the environmental impact of any activities they finance and "clearly justify any suitability claims [they] make".

Some key points in the report, entitled Greening Finance: A Roadmap to Sustainable Investing, include reporting environmental impact using the UK Green Taxonomy, timescales on SDR disclosures and the potential for ESG ratings agencies to come into the scope of Financial Conduct Authority (FCA) authorisation and regulation.

[Firms are required] to disclose the environmental impact of any activities they finance and “clearly justify any suitability claims”

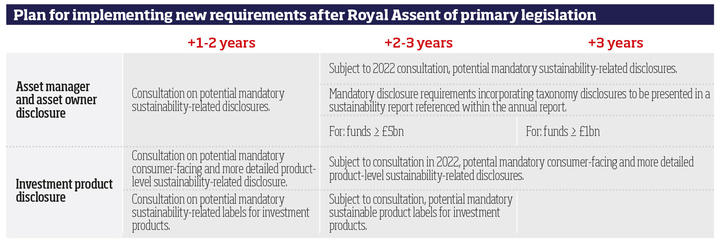

In two-to-three years, managers of funds bigger than £5bn will have to meet mandatory disclosure requirements, which also incorporate taxonomy disclosures, via a sustainability report referenced within their annual reports. This will also be the case for funds larger than £1bn in more than three years' time.

Phil Spyropoulos, partner at law firm Eversheds Sutherland, said the document is "packed with policy announcements" and although it "replays a few old hits", it also contains a lot of fresh material.

"It is evident that the roadmap is the culmination of substantial behind-the-scenes efforts across government departments and with regulators," he told Investment Week. "As the phrase ‘roadmap' suggests, this document sets out the direction of travel but is not itself the destination. Quite a lot of the substance will be subject to further consultation."

Laura Houet, partner at fellow law firm CMS, said her initial reaction to the SDR roadmap was "a mix of excitement and cautious optimism".

"It is great to see the outline plans for extending sustainability disclosures beyond those that the FCA has already consulted on - aligning more with what we have come to expect through SFDR [Sustainable Finance Disclosure Requirements]," she explained.

Houet is also pleased to see the government "recognises that without extending these requirements economy-wide, it will be very hard for the financial sector to do its bit."

Top ten takeaways from Greening Finance: A roadmap to sustainable investing

Steve Kenny, chief distribution officer at Square Mile Investment Consulting and Research, agreed, pointing out that "anything that helps provide clarity is positive".

"There is a lot of detail in the roadmap and some timelines on when consultation papers will be issued, which will be a pre-cursor to the regulation," he said.

"Given the industry was going into an ESG and responsible investment coma, this will help re-invigorate interest. The message, however, is clear that we are moving this forward and there is real impetus."

Finer detail

Despite the 48-page report shedding much more light on what SDR could look like for the UK asset management industry, some questions remain as to how changes will be implemented.

Mikkel Bates, regulatory manager at FE fundinfo, said the publication of the roadmap is "just phase one of the government's stated plan to inform investors, act on the information provided and then shift financial flows to help deliver on the net-zero commitment".

"What seems to be missing are target dates, other than a three-year-plus timeline ‘after Royal Assent of primary legislation'," he reasoned.

Meanwhile, member and ambassador of the Transparency Task Force and lead of PISCES JB Beckett, argued the report is not so much a ‘roadmap' as a "top-down piggy-back mission statement that will rely heavily on other supranationals and NGOs like IPCC, UKSIF, IIGCC, PRI and the Global Ethical Financial Initiative (GEFI) to quantify and qualify the steps and standards".

"No doubt the Treasury will use the public consultation to do its homework, open the way for lobbying with impunity and let smarter minds fill in the blanks. Exactly why this is coming from Treasury and not Bank of England baffles me," he said.

One potential uncertainty is how SDR will align with other regulatory frameworks, such as the European SFDR, which was introduced in 2019 and first came into effect in March 2021.

Given that SDR has been trailed as the UK's answer to SFDR, Spyropoulos said firms will "no doubt want to understand whether their existing work can be repurposed and adapted for UK disclosure rather than starting anew".

Kenny said there is a belief that the UK will look to consider how the proposed SDR "could be interoperable with SFDR in future".

"However, we will await the FCA's guidance on how this may work," he added.

Bates explained the requirement for fund groups to disclose "how they take sustainability into account" and for funds to report on how their sustainability impact and relevant financial risks and opportunities are "completely in line with SFDR".

"Although the UK Taxonomy has not yet been produced, the document says it ‘draws on the EU approach, which the UK helped design' and the six environmental objectives are exactly the same as the EU Taxonomy, down to applying the climate change mitigation and climate change adaptation before the other four, having technical screening criteria for each economic activity, and requiring any activity to both contribute to at least one objective and also to do no significant harm to any others," he said. "The advantage in the UK is that the FCA will be consulting on the screening criteria for the first two objectives early in 2022, after they are already in place in the EU."

Houet argued that even if there is not the close alignment that the industry would like, "we have learned so much already and have such a clear idea of where the issues with SFDR lie that I would hope for a smoother journey".

She disagreed that the regulation will be a "copy-paste job" from SFDR, although she said "the ideas and principles will remain".

"Considering the TCFD disclosures on which the FCA has consulted, we can see that although there is a desire to be relatively aligned internationally, the UK is not going to entirely tread the EU path," she added.

Data

Another key issue, which could present itself to the end consumer as opposed to the asset manager, is the propensity for "data overload", according to Kenny.

"[There is] perhaps a danger of this becoming overly prescriptive or quantitative which could oversimplify information and miss out on some of the nuances," he warned. "As with everything, we will need to go through a number of iterations to get to a point that what is being provided is both digestible and informative."

Bates added the quality of funds' disclosure will depend on the quality of data they get from their investee companies.

"It is therefore good that corporate disclosure will come into force before fund disclosure," he said. "But corporate disclosure only applies to UK registered and/or UK listed companies, which means many funds will still have gaps to fill."

Beckett added that this could even create a dual system between UK funds and funds sold in the UK.

"This could lead to inconsistencies and will likely raise the cost for fund managers," he warned.

Greenwashing

Ultimately, most commentators believe SDR will tangibly reduce greenwashing in the industry, with Bates pointing out that "clarity and standardisation of the metrics will help to make the disclosures comparable and will lead to greater understanding by investors".

Houet added that "any momentum behind consistent corporate reporting to feed downstream disclosure is going to be very welcome".

However, while Beckett believes SDR could "potentially" reduce greenwashing and "stamp out some of the lazy repackaging of non-green products", he warned some asset managers will "always find ways to game their way around new requirements".

He also hopes SDR will be taken seriously beyond COP26, which starts in Glasgow next week.

"I see a degree of papering going on by the UK Government to green its credentials, as COP co-president," he said. "I suspect the UK Government is undertaking a number of initiatives just ahead of COP to boost media coverage. That does not detract from the need to tackle net-zero or greenwashing."