To be a successful equity investor, it's important to understand how the ups and downs of the economy can affect a company's profitability. But this knowledge alone won't ensure investment success. There are other, non-economic, factors that can have just as strong a bearing on the prospects of businesses or industries. These ‘megatrends' include changes in the environment, technological development and societal beliefs and behaviour.

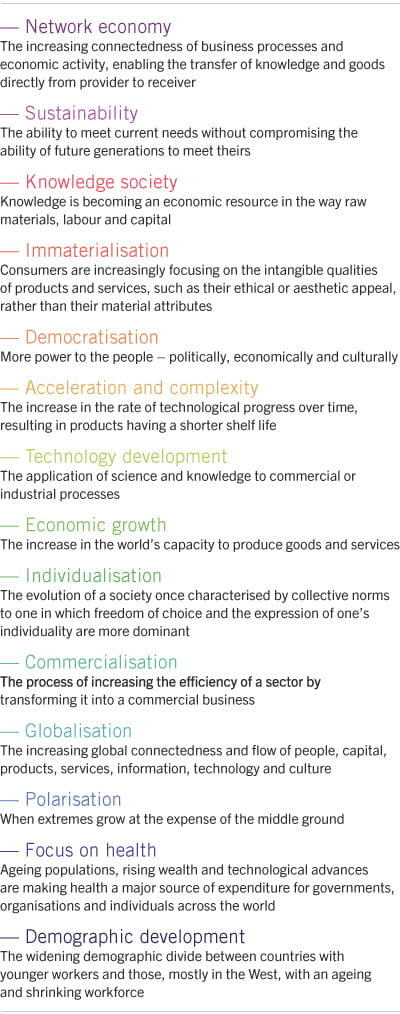

FIG. 1 THE MEGATRENDS TRANSFORMING THE WORLD

Over the past 20 years, and in collaboration with experts such as the Copenhagen Institute for Futures Studies, Pictet Asset Management has dedicated significant resources to the analysis of megatrends and how investors might profit from these powerful forces.

Our research has uncovered 14 distinct structural forces of change (Fig. 1) that, in turn, have provided the foundations for our distinctive family of megatrend-focused thematic equity strategies.

Megatrends in the water industry

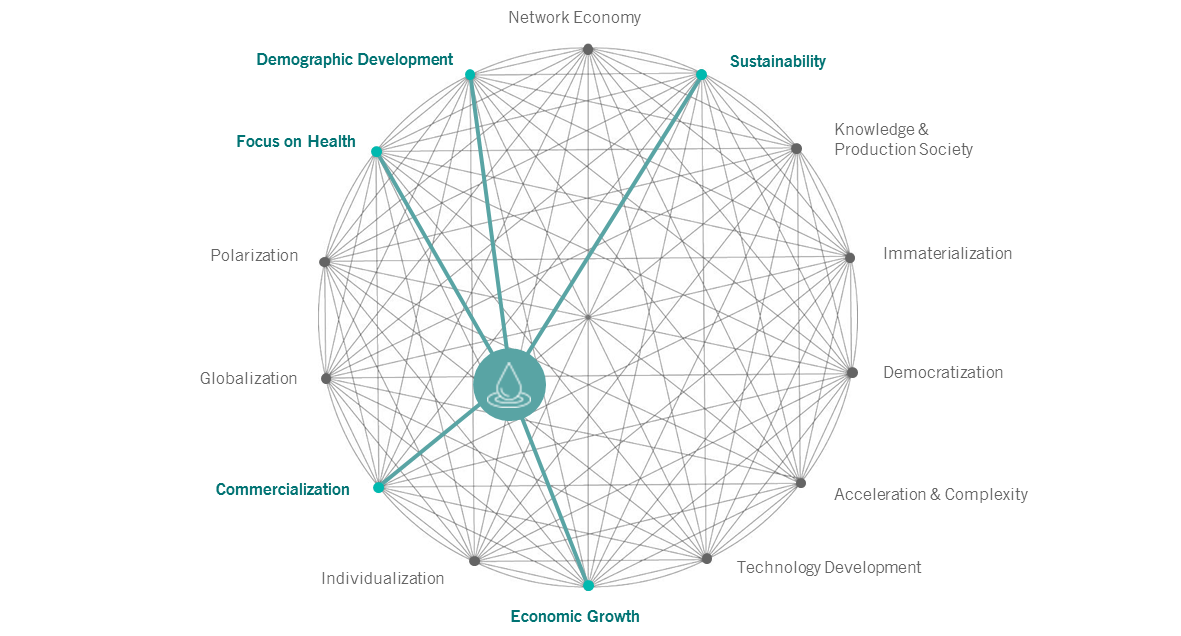

The development of our Water strategy shows how megatrends can give rise to investment opportunities.

In the late 1990s, we discovered that the water industry was about to be transformed by a number of environmental and societal trends.

Climate change and urbanisation - the seemingly unstoppable migration of the world's population from the country to the city - threatened to speed up the depletion of the planet's water resources. At the same time, cities worldwide were increasingly turning to private firms to manage their water resources.

As a result, many companies in the water industry were becoming more investible than they had been for years, prompting us to launch Water fund, the first of its kind and one that would concentrate investments in specialist providers of water preservation and recycling technologies.

FIG. 2 MEGATRENDS AT PLAY IN THE WATER INDUSTRY

Megatrends: the forces powering thematic equities

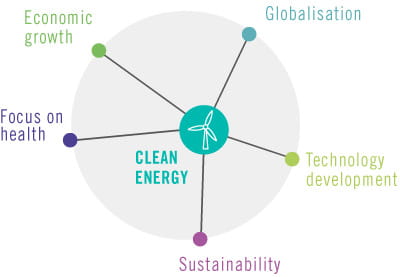

All of the thematic equity portfolios we have launched since pursue the same approach as our pioneering water strategy. Each has been specifically built to capitalise on structural forces of change that evolve independently of the economic cycle. Fig. 3 shows the megatrends underpinning the prospects of companies in our Clean Energy strategy - among which are sustainability - or society's heightened concern for the environment - and technological development, which has resulted in a sharp drop in the production costs of renewable power such as wind and solar.

FIG. 3 THE MEGATRENDS SHAPING THE CLEAN ENERGY INDUSTRY

DISCLOSURES

This marketing material is issued by Pictet Asset Management (Europe) S.A.. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of, or domiciled or located in, any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. Only the latest version of the fund's prospectus, KIID (Key Investor Information Document), regulations, annual and semi-annual reports may be relied upon as the basis for investment decisions. These documents are available on assetmanagement.pictet or at Pictet Asset Management (Europe) S.A., 15, avenue J. F. Kennedy, L-1855 Luxembourg.

The information and data presented in this document are not to be considered as an offer or solicitation to buy, sell or subscribe to any securities or financial instruments.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Pictet Asset Management (Europe) S.A. has not taken any steps to ensure that the securities referred to in this document are suitable for any particular investor and this document is not to be relied upon in substitution for the exercise of independent judgment. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Before making any investment decision, investors are recommended to ascertain if this investment is suitable for them in light of their financial knowledge and experience, investment goals and financial situation, or to obtain specific advice from an industry professional.

The value and income of any of the securities or financial instruments mentioned in this document may fall as well as rise and, as a consequence, investors may receive back less than originally invested. Risk factors are listed in the fund's prospectus and are not intended to be reproduced in full in this document.

Past performance is not a guarantee or a reliable indicator of future performance. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares. This marketing material is not intended to be a substitute for the fund's full documentation or any information which investors should obtain from their financial intermediaries acting in relation to their investment in the fund or funds mentioned in this document.

This document is a marketing communication issued by Pictet Asset Management and is not in scope for any MiFID II/MiFIR requirements specifically related to investment research. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any products or services offered or distributed by Pictet Asset Management.

This article was a paid posting by Pictet Asset Management all views and/or opinions are those of the sponsor and not of Investment Week.

https://datastudio.google.com/open/12nj19QXzYkzyaOFh9ybZZpMh5GIoE7SC