The solutions that can enable global decarbonisation almost fully exist today. Our analysis has concluded that around 80% of decarbonisation can be achieved through wide scale adoption of these existing decarbonisation solutions, with the remaining 20% achievable through carbon capture technologies, carbon sinks and further technological innovation. However, despite the availability of these solutions, adoption rates need to be accelerated due to the short time frame to achieve full decarbonisation by 2050.

To put this in perspective, full adoption of automobiles in the US took 90 years and full adoption of electric power took nearly 50 years. We have less than 30 years to achieve full adoption of renewables, electric vehicles, and agricultural automation solutions, to name a few. In addition, the adoption of decarbonisation technologies will present further challenges for a number of reasons: firstly, the scale of investment (across many different solutions) and the scope of the problem we need to reverse (it has taken us more than 150 years to get to the current dangerous level of emissions) is unprecedented. Secondly, whilst there are many decarbonisation solutions out there, not all of them are economic yet.

Natural adoption rates are therefore not sufficient. Drastically accelerated adoption is essential to reduce net carbon emissions at scale and this is where investors, governments and society have a key role to play. If we do not start to act now, the world will experience catastrophic consequences which are irreversible.

According to Goldman Sachs, the cost of a net zero carbon society, using current commercially available decarbonisation technologies at current prices, is incredibly steep with a total price tag of US$144trn (which equates to 7x current US GDP). This is because many decarbonisation solutions are still nascent and expensive, with high technological costs.

Global decarbonisation will become cost effective when decarbonisation technologies are enjoying economies of scale and are cheaper than their carbon intensive counterparts, which will subsequently lead to mass adoption. Several decarbonisation solutions, such as renewables, are currently economic and operating at scale, whilst others, at the upper end of the cost curve, such as green hydrogen and fuel cell vehicles, require significant additional investment to become economic.

Investors, governments and society have a key role to play

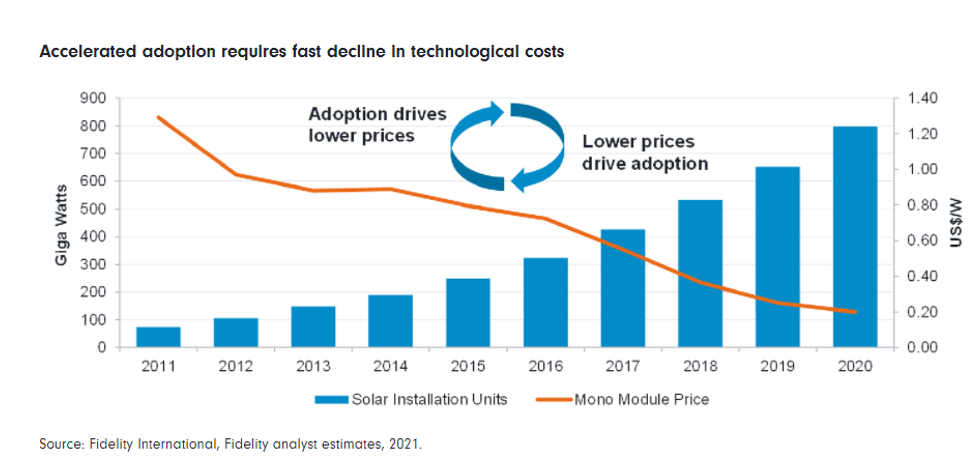

Investors can help improve the affordability of the transition to a net zero carbon scenario and accelerate adoption rates. Accelerated adoption requires a fast decline in technological costs), which is achieved by shareholders funding decarbonisation solutions, helping to increase capacity, facilitate economies of scale and decrease the cost of capital to fund new and low CO2 solutions. All in all, this will improve the cost competitiveness of decarbonisation solutions, making them more affordable and superior to their carbon intensive counterparts.

Investors support however is only part of the solution. Governments and regulators have to support the transition by putting in place adoption targets, carbon taxes, subsidy programs and making decarbonisation policies more aggressive. Individuals have a crucial role as well by making the right choices in their daily lives to support new low carbon solutions and being more consumption conscious.

Approaching an inflection point

This said, significant progress has been made and we are at the inflection point of change. Society's attitude is changing, the number and scope of global decarbonisation policies are accelerating, and investors' preference for environmental and carbon solutions is flourishing. This can be illustrated by the number of climate-related shareholder proposals, which has almost doubled since 2011. Furthermore, the percentage of investors voting in favour of climate related proposals has tripled over the same time period, according to Goldman Sachs research,

These advancements have resulted in the path to decarbonisation already becoming more affordable. This has shifted the de-carbonisation cost curve, which translates to c.US$1tn of annual global savings on the path to net zero. However, we have a long way to go to further accelerate adoption and create economies of scale.

Breaking down the decarbonisation cost curve

Renewables

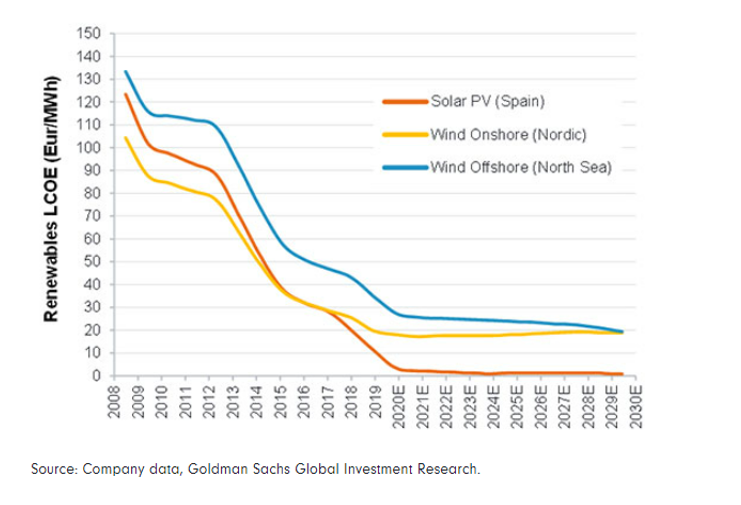

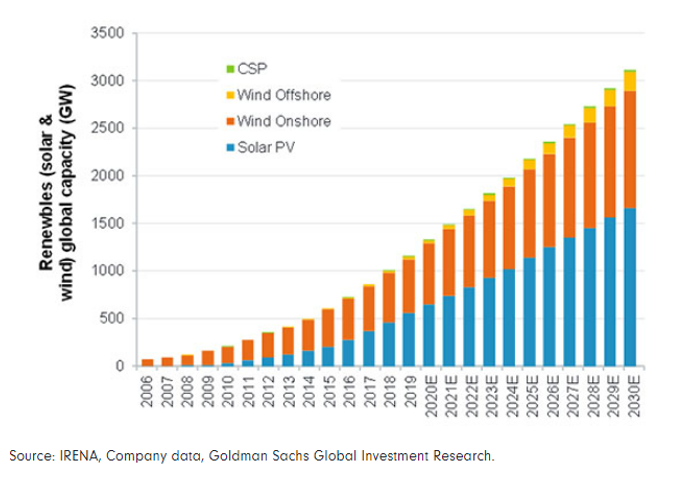

The lower and flatter part of the cost curve is dominated by renewable power (wind/solar), which we believe has the capability to decarbonise electricity and heat generation by more than 90% today.

Historically, these solutions have been supported by global government subsidies and capital markets to accelerate adoption and improve their economics. This has led to a fast decline in technological costs (over 70% since 2016) and a subsequent increase in capacity and adoption rates. Renewables are now cheaper than fossil fuel equivalents in most regions globally.

To fully decarbonise, we need 19x more renewables than we have today - not only to replace thermal coal, but also to support full EV adoption and decarbonisation of cement and steel through providing energy for green hydrogen. Due to attractive economics and subsequent wide scale adoption of renewables, this presents an attractive market for investors due to the elevated demand expected for years to come.

Renewables power costs have decreased by 70%...

...due to economies of scale and technological innovation

Green hydrogen

Green hydrogen sits at the upper end of the cost curve due to low economies of scale, as less than 2% of hydrogen production is green hydrogen produced via electrolysis. This results in high technological costs and capital expenditure requirements associated with electrolysers and cost of electricity. This has translated into hydrogen being more expensive versus other carbon intensive fuel options, for both transport and heating purposes.

These technological costs therefore need to decrease to accelerate adoption rates and unlock the ‘green' hydrogen decarbonisation opportunity. Considerable progress has been made to achieve this. Firstly, government support for green hydrogen is gaining strong momentum due to its vast decarbonisation potential. It represents a major component of the EU's Green Deal and Biden's Infrastructure Plan.

Secondly, green hydrogen technological costs are decreasing rapidly. The two largest components of the cost of green hydrogen are power and capital equipment - the former will continue to decline due to falling renewables costs and the latter due to increasing hydrogen installations scale. Investors thus have a key role to provide further capital to accelerate this cost decline, so companies with the leading green hydrogen technologies can expand capacity and operate at scale.

Electric vehicles (EVs)

EVs are a decarbonisation technology positioned towards the middle of the cost curve, not yet economic but set to be competitive much sooner than green hydrogen. Widescale adoption is required to decarbonise the passenger car industry by 100%. To achieve this, the rate of adoption needs to be fast: across all vehicle segments, the sales of new internal combustion vehicles must be phased out just after 2035 to stay on track for the net zero scenario.

At present, there are a couple of barriers to adoption, including the price of EVs compared to Internal Combustion Engines (ICE), the range of EVs on the market, and limited availability of related charging infrastructure. But these barriers are fading and the upfront cost parity with ICE without subsidies is expected within the next couple of years, which will kick-start mass adoption. This goes hand in hand with an expansion of charging infrastructure, in many cases supported by government policy.

While we have focused on three key areas above, it is important to recognise that accelerated adoption of decarbonisation solutions and technologies is required across all industries if we are to fully decarbonise by 2050.

New technologies

Currently, the path to net zero emissions can't be achieved by decarbonisation technologies alone - the remaining 20% must be achieved through carbon capture and storage technologies and CO2 sink solutions (such as forestation). As with EVs and hydrogen, these technologies have not yet reached large scale adaption and economies of scale, because of a relative lack of investment. The investment opportunity for this market is therefore huge, as full-scale decarbonisation is not possible without these methods. Governments, however, need to also support these solutions.

What does this mean for investors?

As a result of the increasing cost competitiveness and accelerated timeframe towards mass adoption of decarbonisation solutions, the scope of investment opportunity is huge. For example, electric vehicles present a US$46tn market opportunity between today and 2050, renewables adoption needs to accelerate to 19x current levels and hydrogen is expected to grow 4x current levels by 2050.

It is therefore more important than ever for investors to use bottom-up stock selection, to identify the companies with the superior technologies, operating at scale with large barriers to entry, that will provide the highest returns over the long-term.

Important information

This content is for investment professionals only and should not be relied upon by private investors.

The value of investments (and the income from them) can go down as well as up and you may not get back the amount invested. Past performance is not a reliable indicator of future returns. Investors should note that the views expressed may no longer be current and may have already been acted upon. A focus on securities of companies which maintain strong environmental, social and governance (ESG) credentials may result in a return that at times compares unfavourably to the broader market. No representation nor warranty is made with respect to the fairness, accuracy or completeness of such credentials. The status of a security's ESG credentials can change over time. Changes in currency exchange rates may affect the value of investments in overseas markets. Investments in emerging markets can also be more volatile than other more developed markets. Reference in this document to specific securities should not be interpreted as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. Issued by Financial Administration Services Limited and FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM1021/37167/SSO/NA