Consumption is the key pillar of global GDP and will continue to be an important driver of economic growth, especially in Asia, where middle classes are now firmly established. A recent report by McKinsey & Company estimates Asian consumers could represent as much as US$10tn of economic opportunity over the next decade.

Several attributes make this an attractive theme for investors: consumption patterns, in terms of the mix of product groups and the amounts spent, are uniform globally and offer attractive economies of scale. These patterns can also change rapidly, with younger brands supplanting older ones, creating new and dynamic pools of opportunities. Consumer preferences don't stay fixed either, and each generation is shaped by different world events and new technologies.

We consume brands, not products

Back when most of us were still growing up, companies emphasised the functionality of their products. Detergents cleaned clothes so that they were "whiter than white" or toothpaste was endorsed by dentists. Companies were telling us their products did a good job. Today that's not enough.

In the ultra-competitive world of business, consumers typically have a large range of options for any given product. All these products claim they can fulfil a consumers' needs. What companies needed was to differentiate themselves and that led to more distinct marketing with some memorable slogans. Most of us know that "beanz meanz Heinz" for example.

Product branding has now evolved beyond just recognisable images or phrases to communicating values that consumers can identify with. Successful brands have imprinted emotional concepts in consumers - winning, rebelling, belonging...

Apple's 2015 "Start Something New" campaign featured artists creating original works using Apple technology and free drawing and photography workshops were run in its stores. The deeper message was that Apple was for consumers that could dream, create and innovate. You could visit its stores at meet like-minded people and anyone using Apple products was part of the tribe. Apple is the brand of choice for anyone that thinks of themselves as creative.

Tesla is another company with a powerful brand, which we hold to reflect our conviction in the Electric Vehicles (EVs) trend. Tesla spends nothing on advertising, but its vision, mission and personality is crystal clear. Consumers are watching its journey and rooting for the company.

Successful companies need to be skilled at infusing brand identity into their products. Those that win attention and carve out a position for themselves make it very difficult for competitors to dislodge them. Tesla and Apple are masters at this because they understand that brands have become important building blocks for people's lives. We choose brands that we are compatible with to build lives with shared values. By purchasing a product, consumers access its identity and signal that this is what their values are. Brands have infused the consumption choice with meaning.

Sustainable brands are the answer

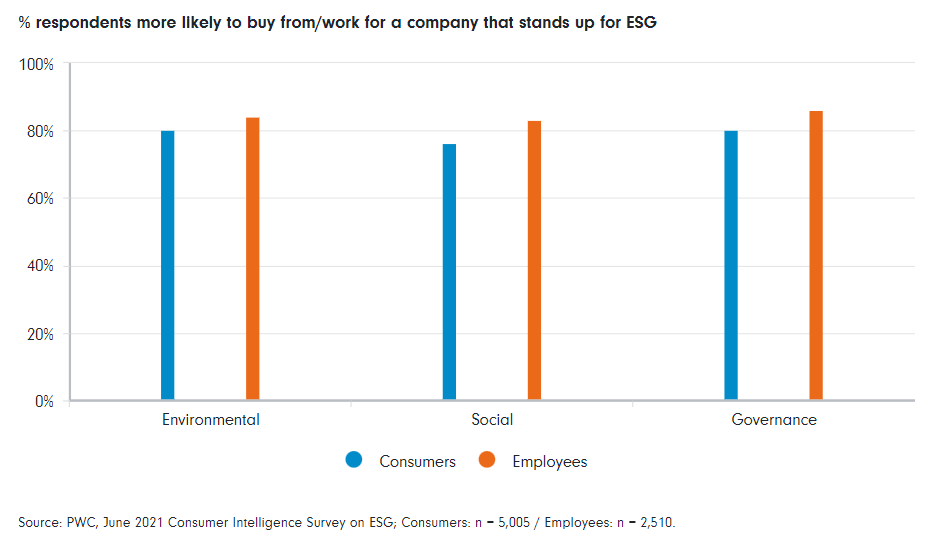

The acceleration in digitalisation over the past decades, which took an unprecedented leap amidst the Covid-19 pandemic, has empowered consumers. In digital economies consumers have easy access to information, which in turn leads them to choose products and services that enhance their wellbeing and the wellbeing of others. Quality therefore becomes more important than price. As a result, consumers are increasingly looking at brands to take a stance.

In particular, it is the younger demographic cohorts of Millennials and Gen-Zs that are increasingly scrutinising companies' strategies to tackle environmental and social issues. They are also willing to use their power as consumers and investors to express views, disassociating themselves from the ones that do not reflect their values. Importantly, this phenomenon applies to consumers all over the world, whether in developed or emerging markets.

As such, consumer-oriented companies that adapt to this by infusing their brands with a sustainable credentials are best placed to maintain and build their industry positions. Indeed, companies that are genuinely sustainable internally and externally have the greatest potential for long-term outperformance.

Attributes for succeeding

Companies that are established on what we call the ‘sustainable brands flywheel' are likely to be attractive investment propositions. The flywheel is a self-reinforcing and perpetuating cycle of growth, profitability and positive net impact on the environment and society.

The sustainable brands flywheel

Source: Fidelity International, 2022.

We believe it is paramount to focus on those companies that, thanks to their mix of fundamental and sustainability credentials, both can and care to benefit from the consumption opportunity in a sustainable manner. By combining internal and external data sources, using statistical analysis and value judgements, we aim to get a sense of a brand's power as well as of its willingness to leverage its resources to develop credible and ambitious sustainability credentials. This is what we believe enables them not only to meet consumer needs, but also do so in a manner that its conscious of the environmental and social impact, further crystallising their pull amongst consumers and, as a result, their market share and pricing power.

To bring it more to life, the clothing industry is one that has come under incremental focus over the past years due to its extensive usage of resources, its large carbon footprint, as well as resulting waste. The industry's supply chains, with scandals over modern slavery and human rights violations have also often made the headlines. By assessing brands in this industry versus the flywheel, we aim to identify businesses whose vision is aligned with a transition to more sustainable industry practices. For example, we focus on the theme of long-lasting, high quality goods, preferring luxury conglomerates such as LVMH and Kering to Inditex, whose portfolio is geared towards "fast fashion" brands such as Zara. We also own platforms such as eBay and Vestiaire Collective, which through their services focusing on re-commerce, enable a transition to more sustainable consumption practices.

We are a world of consumers

Today, brands straddle multiple sectors and industries. Traditional consumer choices are no longer only located in consumer staples and discretionary sectors - they appear across sectors and industries from materials to technology, from healthcare to financials. Consumers demand brands that they can align with in all spheres of their lives.

Companies stewarding their brands must invest in and develop their identities through clever and dynamic marketing. This means staying abreast of the latest consumer trends but also recognising how crucial sustainability is. Not only is sustainability increasingly influential in consumption decisions but it's also a key determinant in how successfully companies can operate and execute projects. Those companies that can build and protect their brands, infusing them with sustainability, will have the power of that brand manifested in strong growth, pricing power and high returns.

Important information

This content is for investment professionals only and should not be relied upon by private investors.

The value of investments (and the income from them) can go down as well as up and you may not get back the amount invested. Investors should note that the views expressed may no longer be current and may have already been acted upon. Changes in currency exchange rates may affect the value of an investment in overseas markets. Investments in emerging markets can be more volatile than other more developed markets.. Reference to specific securities should not be interpreted as a recommendation to buy or sell these securities, but is included for the purposes of illustration only. A focus on securities of companies which maintain strong environmental, social and governance ("ESG") credentials may result in a return that at times compares unfavourably to similar products without such focus. No representation nor warranty is made with respect to the fairness, accuracy or completeness of such credentials. The status of a security's ESG credentials can change over time. Issued by Financial Administration Services Limited and FIL Pensions Management, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0322/370656/SSO/NA

This post is funded by Fidelity International