Fuel for the atomic station

Energy underpins our civilization and is vital for the survival of society. It is needed to heat and light up homes, power factories and transport food, people and everything else. Since the 19th century, we have relied upon oil, gas, and coal for this. These proved to be cheap, reliable, and abundant energy sources, providing the backbone of the world's immense economic progress over the past 150 years.

However, this has come at a cost. It is now widely accepted that the CO2 released when fossil fuels are burned is heating up the planet to catastrophic effect, with far-reaching humanitarian consequences. In response, governments around the world have set ambitious net-zero targets. In total, 83 countries, responsible for 74.2% of global greenhouse gas emissions, have communicated a net-zero target.

A core part of these goals will be decarbonizing electricity generation. Over 40% of energy-related CO2 emissions are due to the burning of fossil fuels for electricity generation.

Therefore, to make significant progress in achieving their net-zero goals, countries need to invest in infrastructure that can replace carbon-producing energy sources with carbon-free energy sources. Changes on the margin will not suffice. Small increases in renewable energy sources and incremental moves toward electric vehicles are considered low-impact tweaks that will barely move the needle.

By contrast, nuclear power has the potential to provide high-impact change that can significantly move the needle. Given that nuclear power can provide an appealing solution, sentiment has turned much more positive in recent years.

Environmental advocates face the tough choices required to decarbonize economies. While there are still holdouts, the political tone toward nuclear power is on the upswing.

Three reasons nuclear power is an appealing investment

- Nuclear is reliable

For a national, state, or local utility, the appeal of nuclear power starts with its reliability. Regions with nuclear power plants deploy reactors round-the-clock, using nuclear as the baseload power source for electric grids. All other power sources depend on less-reliable inputs — whether that's fuels with volatile prices, or natural conditions that are unpredictable and intermittent, like wind, solar and hydroelectric.

- Nuclear is efficient

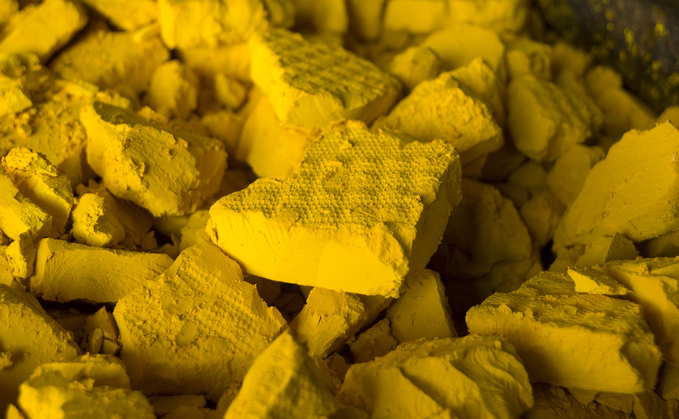

One uranium fuel pellet — about the size of a gummy bear — is the energy equivalent of three barrels of oil, or one ton of coal, or 17,000 cubic feet of natural gas, according to the American Nuclear association.

The energy density of uranium translates to huge efficiencies. Efforts to reprocess or recycle spent fuel in nuclear plants extend uranium's efficiency further. Enriched uranium only uses about 4% of the potential energy in the first cycle through a reactor. As the technology advances to make it more economically viable to recycle fuel, the efficiency of nuclear is likely to rise even higher.

- Nuclear is clean

Nuclear energy generates the lowest greenhouse gases of any power source, period. Over the full lifecycle of nuclear power production, each gigawatt-hour of electricity contributes about three CO2 equivalent emissions per gigawatt-hour of electricity, which is in line with wind and solar. Hydroelectric power sources generate 10 times more CO2 equivalent emissions; oil and coal generate 240 and 273 times more, respectively.

Source: Energy.gov. Measures CO2-equivalent per gigawatt-hour of electricity over the lifecycle of a powerplant.

A new uranium bull market?

The changing sentiment toward nuclear power is driving the first signs of a new uranium bull market.

Since the advent of nuclear energy, uranium, as a commodity, has seen two other bull markets. The first was in the 1970s. The defining feature of that decade was an energy crisis, due to the OPEC oil embargo, and geopolitical tensions, in the form of the Cold War. The energy crisis encouraged governments to turn to nuclear energy while the Cold War saw governments stockpile uranium for potential military use. This strong demand resulted in a bull market between 1973 to 1978.

The next bull market came during the commodity supercycle of the 2000s. Surging oil prices resulted in many expecting a renaissance in nuclear energy. That bull market ended with the onset of the Global Financial Crisis and the requestioning of nuclear energy following the 2011 tsunami-driven accident at Fukushima, Japan.

The reaction to that incident, however, is increasingly seen as rash and misguided. Today, we believe we are at the start of a new bull market in uranium. Crucially, there is a deficit in uranium supply. The production of uranium has simply not kept pace with the growing demand for new reactors.

Until recently, the gap between production and demand had little impact on the spot price. This was due to the availability of stockpiles made available at the end of the Cold War. With the de-escalation of tensions, weapons stockpiles were released for use in power plants. However, the availability of that supply is coming to an end. Uranium miners will need to step up production to plug the gap.

Find out more Sprott Uranium Miners UCITS ETF (URNM)

This post is funded by HANetf