Welcome to the opportunity buffet in fixed income. The case for fixed income has become much stronger. In our view, now is the time to get back into it. This is because the global macro environment is turning much more supportive, fixed income is now much better positioned in a multi-asset context and valuations have improved considerably.

The next big question then becomes: Where in fixed income do I want to be positioned? The answer mainly depends on the investor's specific risk appetite, duration target and return objectives. But the good news is that there is something for everyone in global fixed income.

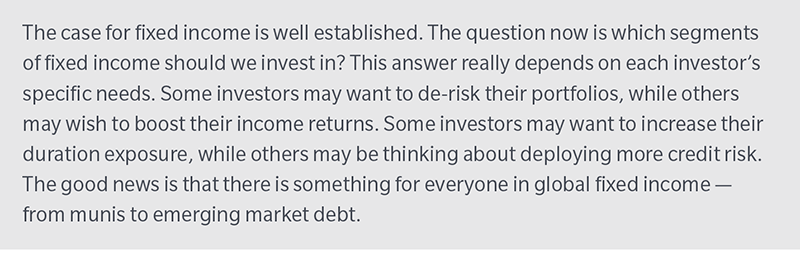

Investing in fixed income is about taking duration risk and credit risk. Global fixed income offers great variety in terms of the combination of these two types of exposures (Exhibit 1). For instance, high yield operates in the high spread/short duration quadrant. In contrast, global treasuries and munis are in the low spreads/longer duration quadrant.

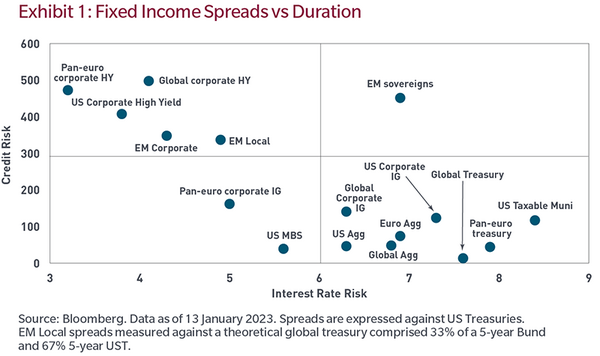

Now looking at the riskiness of fixed income sectors, there is significant variation between the excess return volatility (defined as the 10-year annualized volatility of monthly excess returns) of US mortgages

— the least volatile — and the volatility of EM sovereign debt, which stands at the opposite end of the spectrum, exceeding 8% (Exhibit 2).

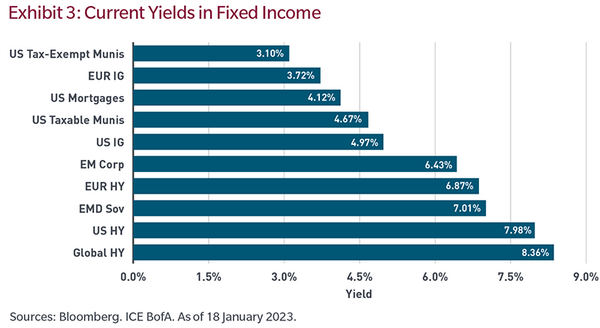

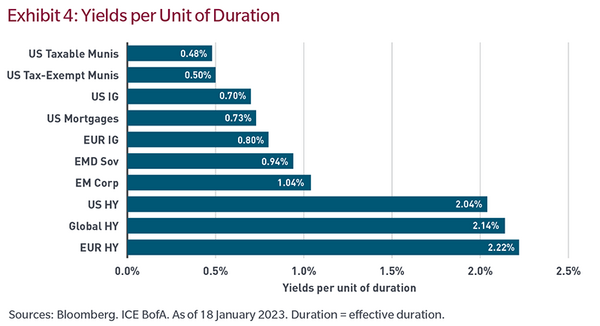

Likewise, there is a yield level suitable for everyone in global fixed income. Looking at our sample of fixed income sectors, yields currently range from about 3% for tax-exempt munis to about 8.4% in global high yield (Exhibit 3). It is also worth looking at the broad range of yield per unit of duration that fixed income offers, with the high yield sectors offering by far the highest yield per unit of duration (Exhibit 4).

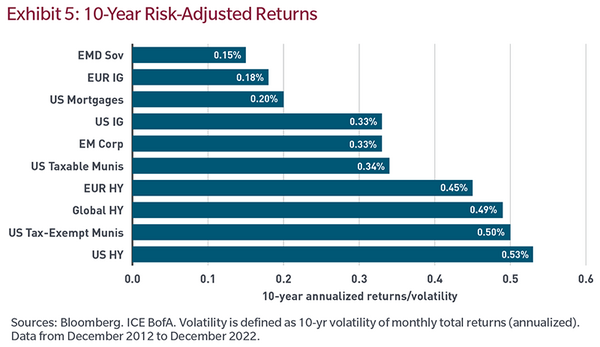

Risk-adjusted returns also display major variation over the long term. Overall, the high yield sectors tend to present more attractive risk-adjusted return profiles than their investment-grade peers. This tends to confirm the significance of income in driving total returns over the long period. Separately, it is interesting to underscore the powerful risk-adjusted return profile of tax-exempt munis in IG, mainly reflecting the low volatility.

Fixed income à la carte. Let's now discuss our selection of attractive opportunities that global fixed income offers, which may address various investor needs and objectives.

Take advantage of cheapest spread valuations in global fixed income

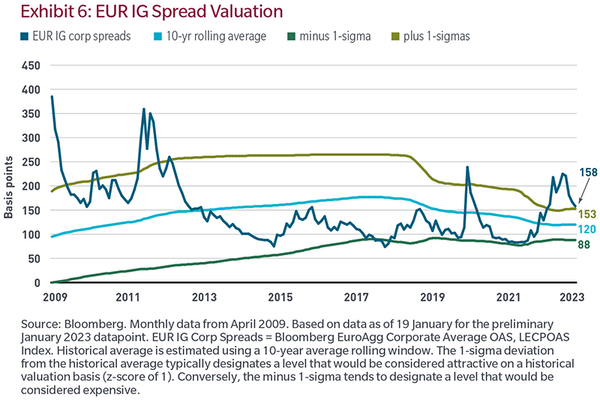

European IG Credit currently screens as the most attractive asset class in global fixed income based on our fixed income valuation screener, with a valuation z-score of 1.16. EUR IG correction has been substantial over the past year, mainly reflecting the impact of European Central Bank policy, mounting

concerns over a recession in the eurozone and the impact of the war in Ukraine. The z-score is a measure of deviation from the average in units of standard deviation. Z-scores are estimated using a 10-year average rolling window. A positive z-score indicates a valuation that is more attractive than the long-term average. Conversely, a negative z-score indicates a valuation that is less attractive than the long-term average. Looking ahead, we believe that EUR credit represents an interesting opportunity for the investor with a longer-term horizon. The current yield stands at 3.8%, a level that is considered attractive from a historical perspective.

Looking ahead, we believe that the future ECB tightening is more than fully priced in, which should limit any risk of market shock coming from ECB action. In addition, while the eurozone is facing severe growth challenges, we believe that it has been partly reflected in asset prices, including in credit spreads. It is also interesting to note that the data have started improving more recently in the eurozone, which may suggest that further macro downside may now be more limited. There have been significant dislocations between sectors, as well as single names in the EUR IG universe, so we advocate exposure to the asset class through an active asset manager who will be able to rely on a robust security selection process.

Position for the potential dollar downturn

EM local currency debt may well stage a recovery in 2023 if the US dollar faces higher correction risks. With tightening by the US Federal Reserve set to be complete soon, there is a possibility that the USD may come under some pressure, especially if the global risk appetite backdrop improves somewhat.

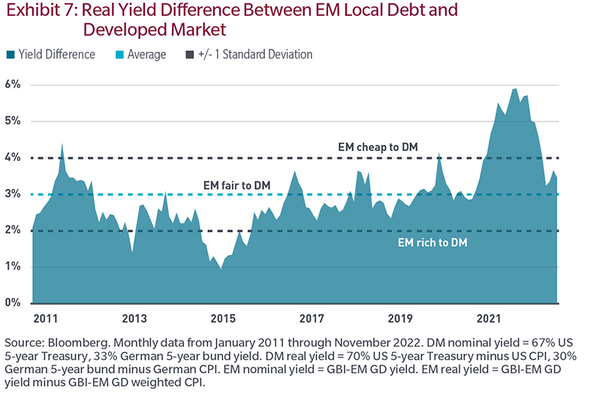

EM local currency debt performance has been quite challenged over the past year, but history shows that periods of substantial drawdowns have been followed by a sharp recovery bounce. EM local debt is amongst the riskiest sectors in global fixed income as they entail EM currency risks. It is, therefore, geared towards fixed income investors with greater risk appetite. EM local currency debt also tends to be more exposed to global macro risks, which means that a robust, top-down framework is necessary to guide investment decisions. In addition, investing in EM always involves avoiding the vulnerable countries, which means a strong sovereign credit analysis should be part of a robust EM investment process. The current yield on EM local debt stands at about 7%, well above comparable yields in developed market government bonds, especially in real terms (Exhibit 7).

Seek protection against US recession risks

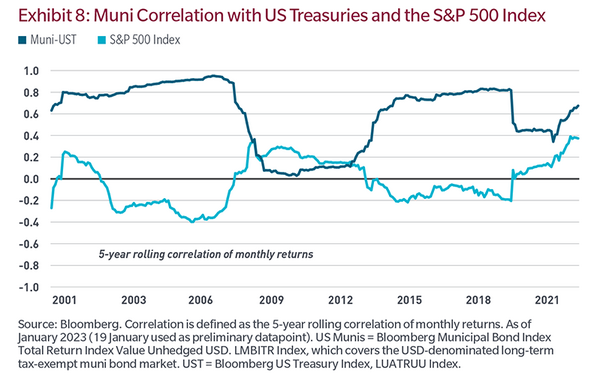

Some investors may be primarily concerned about rising recession risks in the US. If that is the case, tax-exempt munis offer an attractive alternative to outright government bonds, with an opportunity to gain exposure to slightly higher yields. Tax-exempt munis have historically been defensive in nature, exhibiting low correlation returns with equities historically and higher correlations with US Treasuries (Exhibit 8). They also have tended to be less vulnerable to the swings in the business cycle, given that they are supported by strong local state public finances. As underscored above, tax-exempt munis have displayed attractive risk-adjusted return characteristics.

Staying active in fixed income. Given the elevated macro volatility, we advocate active asset management. Volatility may indeed create opportunities for the active asset manager who can engage in active asset allocation, while also taking advantage of potential dislocations that can be identified through a comprehensive research and security selection process. Overall, in our view, the key alpha generation levers include multi-sector asset allocation, yield curves and duration, and security selection. Typically, an active asset manager may also explore relative value opportunities as a way to manage the outright beta risk. Overall, we believe there are many opportunities in the global fixed income universe that may serve specific investment needs.

This post is funded by MFS

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

Distributed by: U.S. - MFS Investment Management; Latin America - MFS International Ltd.; Canada - MFS Investment Management Canada Limited. No securities commission or similar regulatory authority in Canada has reviewed this communication.

Please note that in Europe and Asia Pacific, this document is intended for distribution to investment professionals and institutional clients only.

Note to UK and Switzerland readers: Issued in the UK and Switzerland by MFS International (U.K.) Limited ("MIL UK"), a private limited company registered in England and Wales with the company number 03062718, and authorised and regulated in the conduct of investment business by the UK Financial Conduct Authority. MIL UK, an indirect subsidiary of MFS®, has its registered office at One Carter Lane, London, EC4V 5ER. Note to Europe (ex UK and Switzerland) readers: Issued in Europe by MFS Investment Management (Lux) S.à r.l. (MFS Lux) - authorized under Luxembourg law as a management company for Funds domiciled in Luxembourg and which both provide products and investment services to institutional investors and is registered office is at S.a r.l. 4 Rue Albert Borschette, Luxembourg L-1246. Tel: 352 2826 12800. This material shall not be circulated or distributed to any person other than to professional investors (as permitted by local regulations) and should not be relied upon or distributed to persons where such reliance or distribution would be contrary to local regulation; Singapore -

MFS International Singapore Pte. Ltd. (CRN 201228809M); Australia/New Zealand - MFS International Australia Pty Ltd (" MFS Australia") holds an Australian financial services licence number 485343. MFS Australia is regulated by the Australian Securities and Investments Commission.; Hong Kong - MFS International (Hong Kong) Limited ("MIL HK"), a private limited company licensed and regulated by the Hong Kong Securities and Futures Commission (the "SFC"). MIL HK is approved to engage in dealing in securities and asset management regulated activities

and may provide certain investment services to "professional investors" as defined in the Securities and Futures Ordinance ("SFO").; For Professional Investors in China - MFS Financial Management Consulting (Shanghai) Co., Ltd. 2801-12, 28th Floor, 100 Century Avenue, Shanghai World Financial Center, Shanghai Pilot Free Trade Zone, 200120, China, a Chinese limited liability company registered to provide financial management consulting services.; Japan - MFS Investment Management K.K., is registered as a Financial Instruments Business Operator, Kanto Local Finance Bureau (FIBO) No.312, a member of the Investment Trust Association, Japan and the Japan Investment Advisers Association. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks, including market fluctuation and investors may lose the principal amount invested. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.