Expanding equity multiples and falling risk premia

Enthusiasm around artificial intelligence, falling inflation readings and better-than-feared economic data have all been contributing forces to the strength in global equity markets this year.

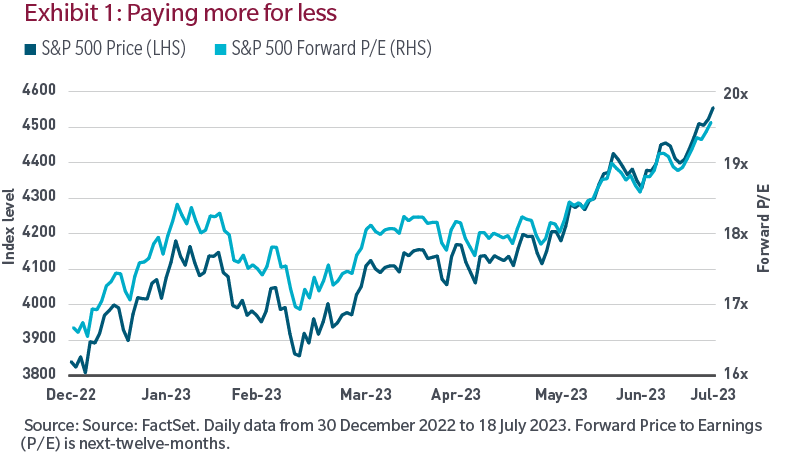

At the same time, earnings growth expectations have been low to slightly negative. With the prices being paid for stocks rising, unaccompanied by higher profit expectations, the P/E multiple on stocks has expanded as shown in Exhibit 1. Investors are paying a lot more for the same profit stream.

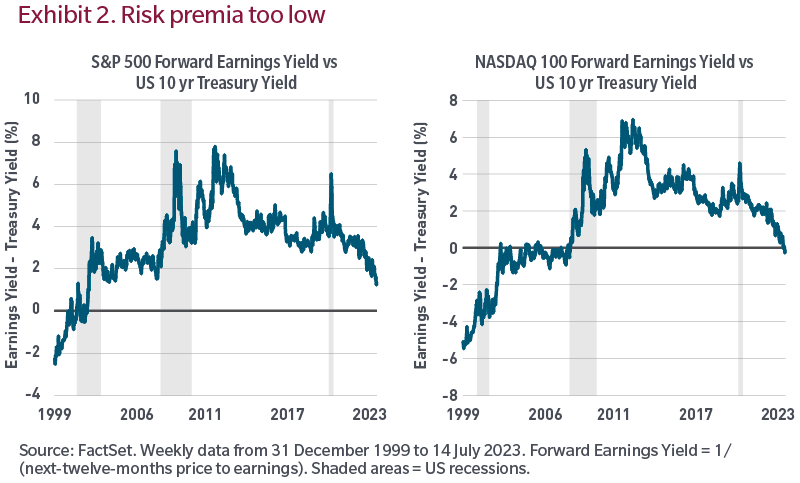

We can also observe this through the lens of equity risk premia. The expected earnings yield on stocks over the yield offered by government bonds has historically averaged 3% to 5%. The combination of interest rates at more normal, free-market levels following the rate-hiking cycle begun in 2022 and this year's equity market rally has pushed risk premia to extremes not seen since the internet bubble. The chart on the right illuminates the negative risk premia for the technology-heavy Nasdaq 100.

A lesson from George Box

Many of today's investors, professional or not, have never experienced a market like this before. They've become conditioned to rising markets and a system that allowed for the privatization of profits and wealth and the socialization of capital losses when markets exhibited sustained stress.

Given that many in today's marketplace are dismissing these warnings signals, perhaps we need to take a different perspective.

Famed British statistician George Box felt all models are inherently flawed by nature of being rooted in the past but understanding those flaws has value. That knowledge allows you to vary the weightings or emphasis placed on different inputs given the assumed or perceived circumstances and differences compared with the past.

Price-to-sales

Earlier, I referred to the internet bubble. Since it popped over two decades ago, many current investors weren't managing portfolios then, yet most are at least familiar with the circumstances surrounding that historic episode.

What is often most remembered were the skyrocketing valuations of businesses with a .com or .net attached to it. But what often gets left out is the enormous capital cycle that the internet created. Computers were being put onto every desktop and connected to each other via the internet. This catalyzed a corporate investment cycle that drove exploding economic and sales growth. Nonetheless, valuations were so outrageous that despite the enormous growth, stocks were very expensive even on a price-to-sales ratio basis.

But the post-2008 business cycle was entirely different. There was no capital expenditure cycle. Deflation fears, falling money velocity and weak end-demand diverted borrowed corporate capital away from fixed investment (e.g., equipment) towards stock repurchases, higher dividends and acquisitions. That combination resulted in the weakest business cycle in over a century and in historically anemic sales growth. Yet stocks did fantastically well because companies were able to drive profitability by suppressing costs amid falling interest expense, the offshoring of labor and falling fixed investment. However, that regime died in 2022, and profit subsidies from low rates, offshoring and underinvestment have not only ended, but reversed.

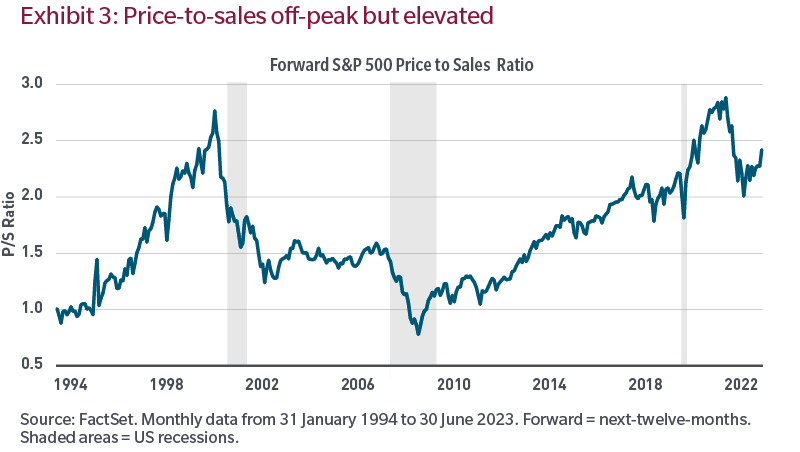

Given how short-term and linear many equity investors are, perhaps forward twelve-month price-to- earnings ratios and earnings yields understate the risks. Leveraging the George Box playbook, Exhibit 3 shows the price-to-sales ratio for the S&P 500 since the mid-1990s.

As noted earlier, despite the high-growth era of the 1990s, equities were expensive even on this growth-dependent metric. Not surprisingly, given how weak the economy and sales growth were throughout the post-2008 business cycle, we saw the ratio expand and reach peaks last seen at the height of the internet bubble. Price-to-sales-fell some in 2021 due to the post-lockdown growth that resulted from fiscal and monetary stimulus, which has since faded and why the ratio is re-accelerating, as stock prices have risen in 2023.

Conclusion

Equities are expensive on traditional valuation measures. The bigger picture, however, is more nuanced. The regime of low capital costs has ended as accumulated debt levels will need to be financed at higher cost, pulling down free cash flow. The cheap labor regime has ended. And the regime of over-stretched supply chains and underinvestment in cleaner (energy) ways of running businesses has ended.

Back to Mr. Box's axiom about models being wrong but some useful, I think of valuation similarly. Every business cycle and market environment is different, and these idiosyncrasies influence the usefulness of various valuation metrics and are why a broad mosaic of valuation inputs, and understanding the flaws in each, can be instructive.

We have begun a new regime. A regime where capital and labor are scarcer than any point since 2009. A regime where not all companies will be able to outearn their new or normalized input costs. A regime of higher loan and bond defaults, capital restructurings and bankruptcies. The tools necessary to successfully navigate the current regime are quite different from the last. As Mr. Box might have suggested, recognize that all valuation and fundamental models are broken, but some are still useful.

Investors will need to do a lot more homework and may find it advantageous to use a mosaic of not only valuation, but also fundamental tools, to help guide the way through this cycle.

How We Invest

Our Active 360° Fixed Income Approach

We believe our active fixed income approach is key to navigating today's challenging bond market and adding long-term value. Our fixed income investment process combines collective expertise, long-term discipline and risk management to capitalise on changing market dynamics.

The fixed income investment team works closely with the equity and quantitative teams, sharing information and debating ideas. We assess the opportunity set as it changes and position our funds' holdings, for the long-term, which benefit from durable credit fundamentals and attractive valuations. We take on risk intentionally when we believe we are being compensated appropriately and reduce it when we don't.

Disclaimers

The price-earnings ratio is calculated by dividing a company's share price by its earnings per share.

The price to sales ratio measures the value of a company in relation to the total amount of its recent annual sales.

The S&P 500 Index measures the performance of the 500 largest US publicly traded companies in the US equity market. The Nasdaq 100 is an index of the hundred largest non-financial stocks listed on the NASDAQ stock exchange.

"Standard & Poor's®" and S&P "S&P®" are registered trademarks of Standard & Poor's Financial Services LLC ("S&P") and Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC ("Dow Jones") and have been licensed for use by S&P Dow Jones Indices LLC and sublicensed for certain purposes by MFS. The S&P 500® is a product of S&P Dow Jones Indices LLC, and has been licensed for use by MFS. MFS's Products are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, Dow Jones, S&P, or their respective affiliates, and neither S&P Dow Jones Indices LLC, Dow Jones, S&P, their respective affiliates make any representation regarding the advisability of investing in such products.

The views expressed are those of the author(s) and are subject to change at any time. These views are for informational purposes only and should not be relied upon as a recommendation to purchase any security or as a solicitation or investment advice. No forecasts can be guaranteed.

Unless otherwise indicated, logos and product and service names are trademarks of MFS® and its affiliates and may be registered in certain countries.

Distributed by: U.S. - MFS Investment Management; Latin America - MFS International Ltd.; Canada - MFS Investment Management Canada Limited. No securities commission or similar regulatory authority in Canada has reviewed this communication.

Please note that in Europe and Asia Pacific, this document is intended for distribution to investment professionals and institutional clients only.

Note to UK and Switzerland readers: Issued in the UK and Switzerland by MFS International (U.K.) Limited ("MIL UK"), a private limited company registered in England and Wales with the company number 03062718, and authorised and regulated in the conduct of investment business by the UK Financial Conduct Authority. MIL UK, an indirect subsidiary of MFS®, has its registered office at One Carter Lane, London, EC4V 5ER. Note to Europe (ex UK and Switzerland) readers: Issued in Europe by MFS Investment Management (Lux) S.à r.l. (MFS Lux) - authorized under Luxembourg law as a management company for Funds domiciled in Luxembourg and which both provide products and investment services to institutional investors and is registered office is at S.a r.l. 4 Rue Albert Borschette, Luxembourg L-1246. Tel: 352 2826 12800. This material shall not be circulated or distributed to any person other than to professional investors (as permitted by local regulations) and should not be relied upon or distributed to persons where such reliance or distribution would be contrary to local regulation; Singapore -

MFS International Singapore Pte. Ltd. (CRN 201228809M); Australia/New Zealand - MFS International Australia Pty Ltd (" MFS Australia") holds an Australian financial services licence number 485343. MFS Australia is regulated by the Australian Securities and Investments Commission.; Hong Kong - MFS International (Hong Kong) Limited ("MIL HK"), a private limited company licensed and regulated by the Hong Kong Securities and Futures Commission (the "SFC"). MIL HK is approved to engage in dealing in securities and asset management regulated activities

and may provide certain investment services to "professional investors" as defined in the Securities and Futures Ordinance ("SFO").; For Professional Investors in China - MFS Financial Management Consulting (Shanghai) Co., Ltd. 2801-12, 28th Floor, 100 Century Avenue, Shanghai World Financial Center, Shanghai Pilot Free Trade Zone, 200120, China, a Chinese limited liability company registered to provide financial management consulting services.; Japan - MFS Investment Management K.K., is registered as a Financial Instruments Business Operator, Kanto Local Finance Bureau (FIBO) No.312, a member of the Investment Trust Association, Japan and the Japan Investment Advisers Association. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks, including market fluctuation and investors may lose the principal amount invested. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.