T. Rowe Price's Chief European Economist, Tomasz Wieladek looks at why Europe must tread a fine line to avoid stagnation

Key Insights

- Europe looks set for a mild recession in 2024 before returning to growth, but tight financing conditions and geopolitical uncertainty could hamper the recovery.

- The key risk is a return to pre‑pandemic‑era stagnation, and the European Central Bank will need to calibrate policy very carefully to prevent this from occurring.

- An earlier‑than‑expected rate‑cutting cycle would favour bunds and would likely weaken the euro against other currencies.

Europe very likely faces several quarters of negative, or at least stagnating, growth in 2024. How long this period lasts will depend on several factors, but the most likely scenario is that the eurozone undergoes a mild to medium‑sized recession before returning to growth toward the end of next year. However, the risk of a more prolonged period of stagnation cannot be ruled out, particularly if the European Central Bank's (ECB's) monetary policy remains too tight for too long.

A faster‑than‑expected drop in inflation would likely prompt the ECB to cut rates sooner rather than later. This would favour German bunds but would weaken the euro. European stocks are likely to remain muted until the recovery begins, at which point cheap valuations may provide a buying opportunity.

Demographics pose challenge for eurozone's biggest economies

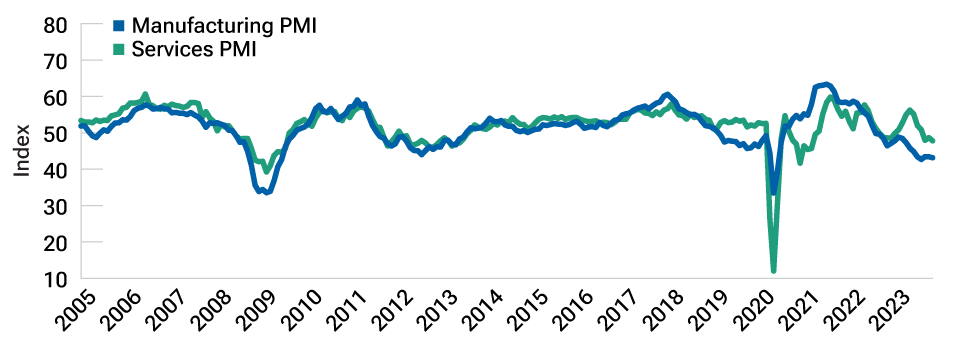

Recent Purchasing Managers' Index (PMI) surveys indicate that the European economy is already in recession. German manufacturing data are very weak, and French manufacturing PMIs have been falling to a similar level. Manufacturing PMIs in Italy and Spain have improved a little, but from very low levels. Services PMIs are weakening across the whole of the eurozone. Overall, these dynamics suggest that the currency bloc is close to the bottom of its manufacturing cycle but the deterioration in the services sector could have further to run (Figure 1).

The deterioration in services likely has further to run

(Fig. 1) The manufacturing cycle may already be close to the bottom

As of October 31, 2023. Source: S&P Global. See Additional Disclosure.

Germany, Europe's manufacturing motor, faces multiple challenges. In the 2000s, social benefit reforms significantly raised workforce participation rates among middle‑aged Germans, keeping wage levels competitive. European Union accession countries provided a further source of skilled and competitively priced labour, while Russia supplied cheap energy and Chinese just‑in‑time inputs allowed Germany to focus on higher value‑added manufacturing.

Since then, many of these tailwinds have turned into headwinds. Social benefits cannot be reformed much further, and there are fewer economic migrants. Germany needs approximately 400,000 immigrants each year to plug the gap in its workforce left by an aging population but is struggling to attract them. The economy is being slowly weaned off Russian gas, and some strategic supply chains are being reconfigured. These structural changes will keep growth in Germany subdued for several years while it transitions to a new economic model. In the past, fiscal policy would have been deployed to ease the pain during this process, but Germany's debt brake rule means this is not feasible this time.

Italy will experience similar challenges to Germany on the manufacturing side, and, given its very high debt levels, the government is similarly constrained in its use of fiscal policy. France has an active industrial and fiscal policy, which will help to cushion the transition. France is the only large country in the eurozone with sustainable demographics, which means that it should be much less affected by population aging. Spain's economy has a much smaller share of manufacturing than the other countries. It could still be affected by a eurozone‑wide services downturn, yet surveys indicate that the Spanish economy continues to be by far the most resilient.

This post was funded by T. Rowe Price

Important Information

For professional clients only. Not for further distribution.

This material is being furnished for general informational purposes only. The material does not constitute or undertake to give advice of any nature, including fiduciary investment advice, and prospective investors are recommended to seek independent legal, financial and tax advice before making any investment decision. T. Rowe Price group of companies including T. Rowe Price Associates, Inc. and/or its affiliates receive revenue from T. Rowe Price investment products and services. Past performance is not a reliable indicator of future performance. The value of an investment and any income from it can go down as well as up. Investors may get back less than the amount invested.

The material does not constitute a distribution, an offer, an invitation, a personal or general recommendation or solicitation to sell or buy any securities in any jurisdiction or to conduct any particular investment activity. The material has not been reviewed by any regulatory authority in any jurisdiction.

Information and opinions presented have been obtained or derived from sources believed to be reliable and current; however, we cannot guarantee the sources' accuracy or completeness. There is no guarantee that any forecasts made will come to pass. The views contained herein are as of the date noted on the material and are subject to change without notice; these views may differ from those of other T. Rowe Price group companies and/or associates. Under no circumstances should the material, in whole or in part, be copied or redistributed without consent from T. Rowe Price.

The material is not intended for use by persons in jurisdictions which prohibit or restrict the distribution of the material and in certain countries the material is provided upon specific request.

It is not intended for distribution to retail investors in any jurisdiction.

This material is issued and approved by T. Rowe Price International Ltd, 60 Queen Victoria Street, London, EC4N 4TZ which is authorised and regulated by the UK Financial Conduct Authority. For Professional Clients only.

© 2023 T. Rowe Price. All rights reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the bighorn sheep design are, collectively and/or apart, trademarks or registered trademarks of T. Rowe Price Group, Inc.