What is Aegon Asset Management's climate informed approach and why is it beneficial for investment portfolios?

There's a clear and present risk associated with climate change and what that means for the real economy, for asset owners and the implications for the future value of those assets. With the evolving regulatory landscape and the demand for solutions from investors, we've designed a framework to assess the risk, opportunities, and the potential impact on companies.

Our approach is forward-looking and designed to understand how companies adapt their strategy and business model to consider these evolving risks. In the context of fixed income, we're looking at the sustainability of future cash flow, future debt repayment profiles and looking to identify companies we think have the greatest resilience and sustainability through that transition process.

What is the climate transition research framework and what does it focus on?

Developed by our Responsible Investment team, the framework is asset class agnostic and made to assess a company's strategy and transition towards a Net Zero aligned future. The process is twofold, there is a base assessment, followed by a sector-specific adjustment.

The base assessment looks at three key areas which include commitment to Net Zero with strong short- and medium-term targets covering scope 1,2, and 3 emissions, historical carbon reductions, and good integration of climate risks and opportunities within business strategy and capex decisions.

The sector specific adjustment is focused on what we call the high influence sectors. These are the sectors deemed to have a stronger ability to influence the energy transition and the achievement of global climate goals and include higher carbon emitting sectors like oil and gas, utilities, and real estate. We include banks and insurance companies in this group due to their ability to direct capital and potentially influence corporate behaviour through capital lending.

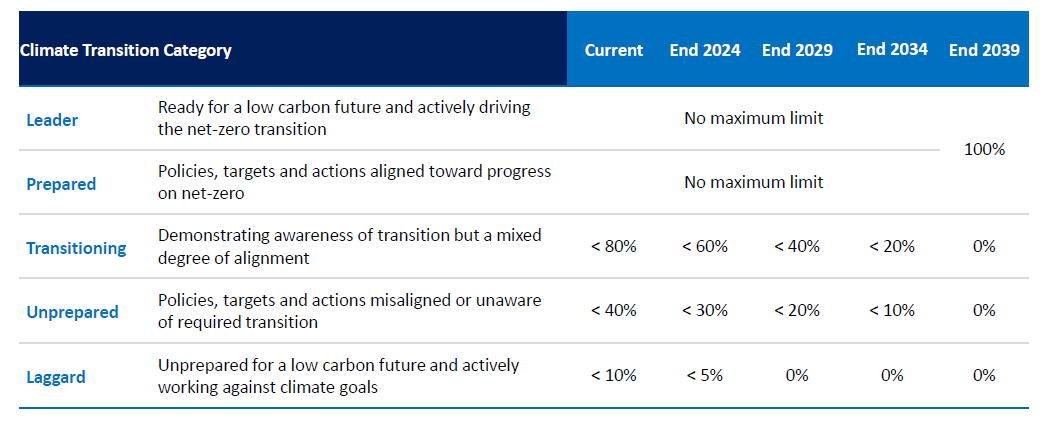

Here, we categorise each company's climate transition profile on a 1-5 basis from ‘Leader' to ‘Laggard.' Engagement is then focused on companies requiring the most improvement.

The idea is not to exclude parts of the economy. On the one hand, we could manage a portfolio like this by simply not investing in dirty utilities or real estate names and investing only in low carbon industries. However, the impact here would be minimal because it's just avoiding carbon and passing it onto somebody else. The climate doesn't benefit from that approach.

We are buying names that are not necessarily great today from a climate transition perspective; but which have robust and credible plans to improve and to transition to net zero. We look to engage with those names, give them support and even put some pressure on them to adapt to a better future.

The engagement aspect is crucial, and our efforts are focused on the high influence sectors and are either unprepared or laggards in the portfolios.

What are some of the advantages of this framework?

From an engagement perspective, it sets out specific objectives that we can look to try to influence a company's behaviour, particularly for a laggard. We can ask them if they have net zero goals, interim targets, or what their disclosure process is like, for example.

We can also ask companies to tighten up targets, improve their efforts in industry-specific areas, move CapEx towards greener solutions, and so on. The ability to engage and seek specific objectives to help companies move forward within our framework is very clear.

As bond investors, while we don't have a seat at the voting table, we can do more to encourage companies to move to net zero goals. Engagement is effective, but it takes time.

We've had situations in our portfolio, even in the short-dated portfolio, where we've sought to engage with a laggard and we've not had success in terms of getting a positive response. When that bond matures, we can choose not to reinvest in that company, if it's not a short-dated bond, we can disinvest. Overall, the direction of travel is positive, but there needs to be more action by bond investors to try to make a difference.

What type of investors can your solutions be suitable for?

We've had interest from retail and institutional investors, so the solutions are a broad fit. Regulatory and reporting obligations such as TCFD are driving more clients to pay closer attention to and disclose their carbon footprints, and our solutions can help clients reduce the carbon footprint of their investment portfolio.

The framework has been successfully implemented in our Short-Dated Funds and that's attractive for investors as an efficient step into investment grade bonds in a relatively defensive part of the market.

We're also finding that because we're invested globally, the diversification that we can offer within the context of the climate framework is not restrictive. We're deliberately investing across every sector and not aiming to exclude sectors that might be dirty.

For Professional Clients only and not to be distributed to or relied upon by retail clients.

Responsible investing is qualitative and subjective by nature and may not reflect the beliefs or values of any one particular investor.

Past performance is not a guide to future performance. Opinions and examples represent our understanding of markets: they are not investment recommendations advice.

All data is sourced to Aegon Asset Management UK plc unless otherwise stated. The document is accurate at the time of writing but is subject to change without notice. Data attributed to a third party is proprietary to that third party and is used by Aegon Asset Management under licence.

Aegon Asset Management UK plc is authorised and regulated by the Financial Conduct Authority.

Adtrax 6732252.1; Expiry 30 June 2025