Scott Roth, CFA, Head of Global High Yield and Chris Sawyer, Head of European High Yield, Barings

Elevated yields and the potential for attractive income and carry continue to draw investors to high yield, despite a mid-summer spike in volatility and an overall modest spread tightening year-to-date. While markets are anticipating cuts in policy rates by central banks, the higher-for-longer backdrop also looks likely to persist, which bodes well for the asset class. To be sure, there are a number of risks that could introduce bouts of volatility in the coming months. But high yield has proved its mettle so far and looks well-positioned to stay the course.

Reasonable Fundamentals, Strong Technicals

Across high yield issuers, fundamental credit metrics remain sound overall despite some modest softening in recent quarters, with many having shored up their financial positions over the past few years. Interest coverage remains healthy in both the U.S. and European markets, at roughly 4.9x and 4.7x, respectively.[1] The credit rating composition of the global high yield bond market remains near a record level of quality. Specifically, the percentage of BB-rated issuers in the global high yield bond index is near all-time highs, at 55%, while the percentage of CCC-rated issuers is around 11%—roughly two-thirds of what it as a decade ago.[2]

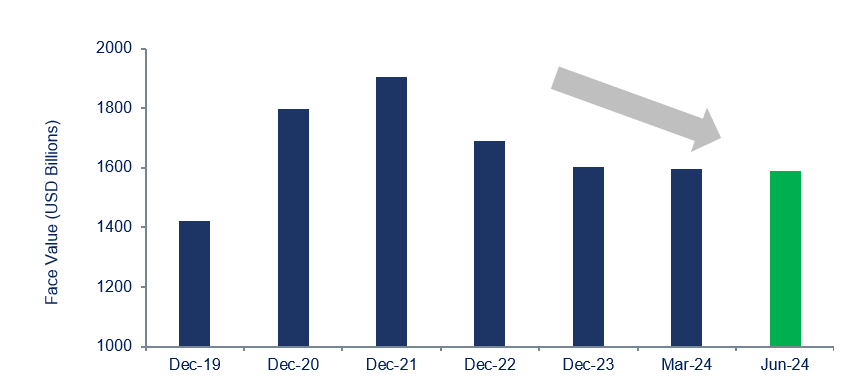

From a technical perspective, unusually strong and positive forces continue to prevail. In bonds, there is a dearth of supply and the overall market has shrunk by around $300 billion, or just under 17%, since the end of 2021 (Figure 1). This has been due, largely, to three forces: the lower level of M&A activity as some private equity firms struggle to find buyers for companies that were acquired or recapitalised during the years of much lower rates; light new issuance, although refinancings should pick up toward year-end; and the upgrading of many high yield credits to investment grade over the last 18-24 months as companies took material steps to pay down debt and increase liquidity.

Figure 1: The HY bond Market Has Shrunk, Providing a Strong Technical Backdrop

Source: ICE BofA. As of June 30, 2024.

In loans, the breakneck pace of collateralised loan obligation (CLO) creation by asset has accounted for an estimated two-thirds of loan demand, which we expect will outpace supply through the remainder of the year. On the supply side, primary market activity has increased modestly but remains concentrated in refinancing transactions from private equity firms issuing loans to extend the life of their current borrowings to match what have become longer holding periods. There also have been roughly $23 billion of private debt deals that have returned to the public market to refinance year-to-date-with that number expected to potentially double by year-end.[3]

Positive Momentum in Loans and Bonds

While the Federal Reserve is set to embark on a rate cutting cycle, we expect rates to remain higher than the market anticipates. This should bode well for loans. Average loan coupons are at roughly 9%, well above the long-term average of 5.6%.[4] Importantly, most of the return comes from contractual income being paid today rather than awaiting price recovery. At the same time, the income component has historically resulted in a steadier return profile.

Bonds remain compelling as well. At just over three years, the market's average duration suggests that bonds are more protected from interest rate swings than in the past.[5] Another key feature of the market is its callability. While spreads and yields-to-worst are calculated based on a bond's legal maturity, most high yield companies refinance early, typically adding 50 to 100 basis points of return when bonds are trading at a discount to par, as they currently are. Based on our estimates, about 25% of the market today is underpriced based on this dynamic.[6]

Looking ahead, we expect 2024 to be a strong year for high yield overall—but that's not to say the next several months will be without risks. In this environment, the value of rigorous analysis from teams with both breadth and depth of resources remains significant.

For Professional Investors / Institutional only. This document should not be distributed to or relied on by Retail / Individual Investors. Any forecasts in this material are based upon Barings opinion of the market at the date of preparation and are subject to change without notice, dependent upon many factors. Any prediction, projection or forecast is not necessarily indicative of the future or likely performance. Investment involves risk. The value of any investments and any income generated may go down as well as up and is not guaranteed by Barings or any other person. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. 23/3818437